Synopsis

Stop stressing over cash. Stop being your customers bank. Download the BusinessCPR™ A/R Collection Process + Tools to improve your ability to collect the monies owed to you.

Your cash only helps you when it’s available to use. Allowing your customers to hold onto your cash because you are afraid to trouble them for your money leads to avoidable business problems. Click here to download the BusinessCPR™ A/R Collection Process + Toolset.

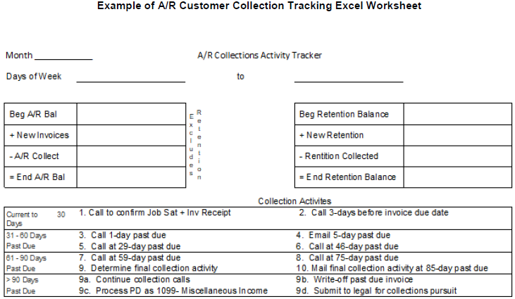

Business owners who are smart with cash have an A/R collection process they use to ensure they get paid on time. They manage their collection process to ensure timely and systematic follow-up on the monies owed occurs with discipline so that they collect the money owed for the work they have performed when it’s due.

Your A/R collections process is how you collect the money owed to you by your customers per the contract terms as established at the time of the sale and restated on the invoice. You reduce the need for external working capital financing by being more disciplined and deliberate in collecting the monies owed to you for work completed based on the agreement entered into before any work was begun.

You reduce the need for external working capital financing by being more disciplined and deliberate in collecting the monies owed to you for work completed based on the agreement entered before any work was begun. Your A/R collections process is how you collect the money owed to you per the contract terms established at the time of the sale and restated on the invoice.

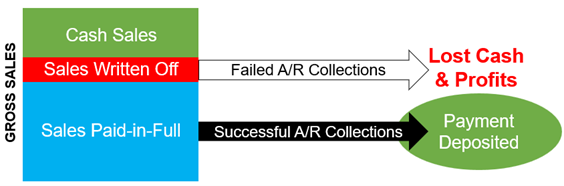

Any time you extend payment terms to a customer, you have extended a business loan to your customer to purchase from you. For many businesses, financing your customers is a required cost of business should you want that customer to buy from you. The problem for most small business owners is they fail to dial up their collection efforts with their past-due customers as their bank does with them when bank loan payments are late.

Anytime your customer’s A/R days outstanding balance exceeds your mutually agreed payment terms, you are slowing your cash velocity. Allow them to be over 45 days past due, and you will have cash flow problems. Allow them to never pay you for what you sold them, and you will have zero cash velocity on that sale.

It is good business to act more like any lending institution when it comes to collecting the money owed to you. When you extend financing to your customers, you are adding a financial services arm to the product manufacturing and or service delivery you do. Hoping you will get paid someday whenever your customers are late in paying you is not good business. Neither is allowing your company to be your customer’s long-term bank by allowing them to hold onto your money because you don’t take disciplined action to collect your money.

The visual below reinforces how there is only one of two outcomes for every sale made on terms.

If you are still struggling after reviewing the BusinessCPR™ A/R Collections Process, click here confirm how critical your A/R collections problem is through a “free” assessment by a certified BusinessCPR™ Business Scientist. Within twelve hours of receipt of your current A/R Aging and Balance Sheet reports, you will receive back email your free A/R collections risk assessment profile.

Stop being your customers bank

If you are still struggling after reviewing the BusinessCPR™ A/R Collections Process, click the link below to confirm how critical your A/R collections problem is through a “free” assessment by a certified BusinessCPR™ Business Scientist. Within twelve hours of receipt of your current A/R Aging and Balance Sheet reports, you will receive back email your free A/R collections risk assessment profile.

FREE ASSESSMENT