Synopsis

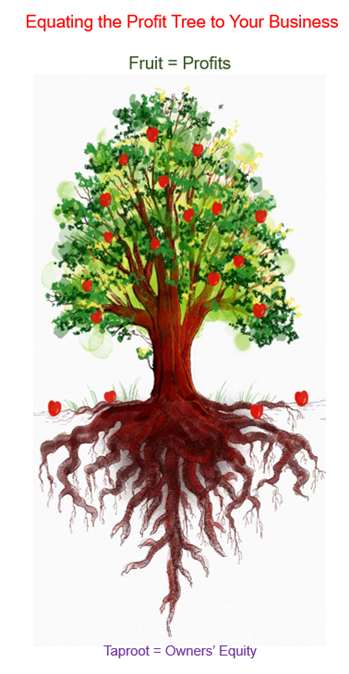

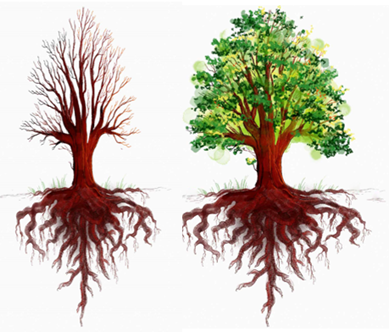

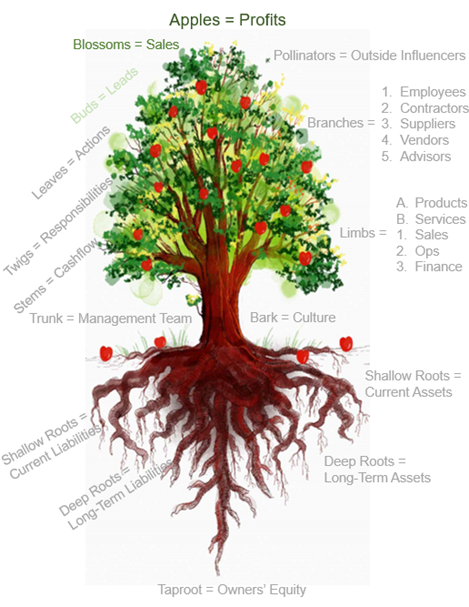

The Allegory of the Profit Tree uses an apple tree to show the inner workings of a profitable business that equates the harvested apples of a tree to profits and the taproot to Owners’ Equity. The allegory shows how you maximize your financial gain when every business element is working together just as they do in a healthy apple tree. Fail to manage the roots and the crown of your business effectively, and you will make less money. Run out of cash because you allow the crown of your business to grow faster than the roots can sustain, and you will go out of business.

An allegory is a literary device in which one object or event describes or represents another. Allegories are characteristically a story, poem, or picture that can be interpreted to reveal a hidden meaning that can lead to new insights.

In the Allegory of the Orchard, an astute observer likened a successful business to an orchard and its master. The latter had carefully planted and nourished multiple trees that had waxed old and begun to decay. Through this allegory, the reader sees how an owner works with their management team to prevent their prized trees from dying.

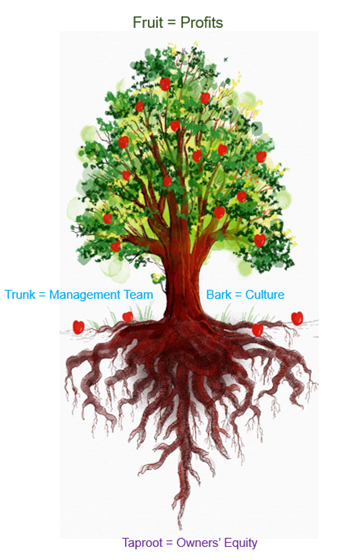

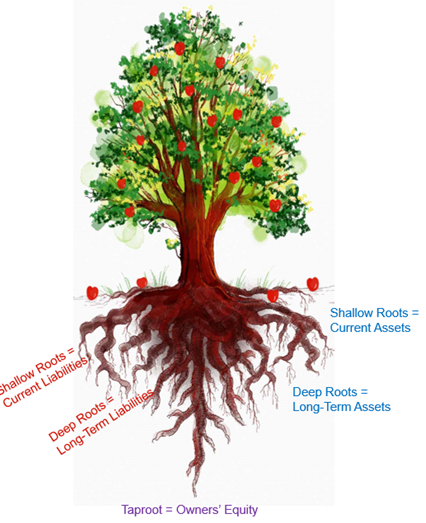

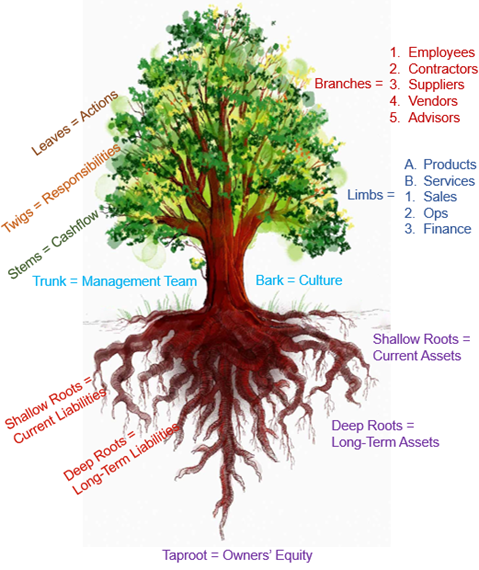

The Allegory of the Profit Tree uses an apple tree to show the inner workings of a profitable business that equates the harvested apples of a tree to profits and the taproot to Owners’ Equity as reflected below:

Why do entrepreneurs set out to own a business?

The number one reason entrepreneurs start or buy a business is to realize a financial gain from their investment of capital and time in the business. Both Profit and Owners’ Equity represent this financial gain that is the difference between the amount earned and the amount spent in buying, operating, and producing a product or service for customers to buy from you at a profit to you.

Profit designates the financial benefit realized when the revenue generated from a business activity exceeds the expenses, costs, and taxes involved in delivering a product or service. Profit is calculated as total revenue less total expenses.

The Owners’ Equity represents the owner’s investment in the business minus the owner’s draws or withdrawals from the business plus the net income (or minus the net loss) since the business began. It is also called net worth, shareholders’ equity, or shareholders’ funds. Owners’ Equity is calculated by deducting the book value of the liabilities of a business from the book value of the assets. It represents the owner’s claim on the assets of the business.

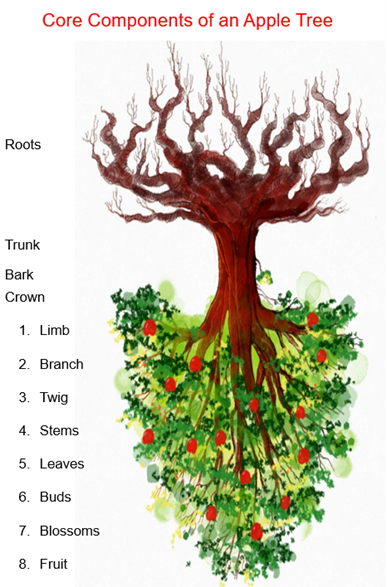

Core components of an apple tree reinforce how Profits and Owners’ Equity work together

Apple trees need full sun and well-drained soil to thrive. They start from a seed that takes root, followed by the forming of a truck with bark that ultimately forms into a crown. The tree crown is the top part of the tree, which features limbs, branches, and twigs that grow out from the main trunk and support the various leaves used for photosynthesis.

In looking at the core components of an apple tree from the bottom-up perspective, you better see what’s most important to the development and long-term health of the tree.

Without the roots, trunk, limbs, branches, stems, and leaves working together, an apple tree would never produce buds, blossoms, or fruit. Put another way, the amount of delicious apples an apple tree produces is proportionate to the health of the core components of a tree working together to grow each apple.

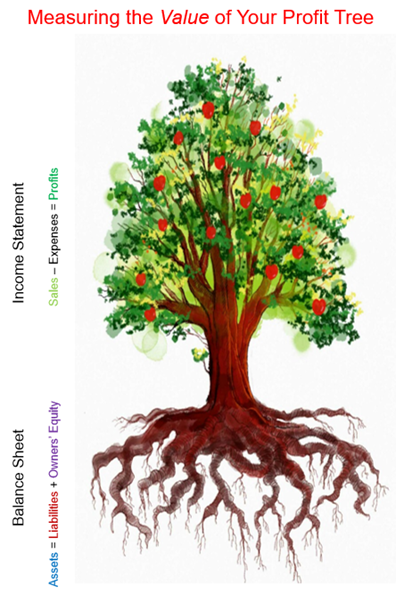

The value of any business is defined by the results reported in two financial statements

Your business’s financial statements are the accounting records that report on the business activities and the financial performance of your business. The two most commonly used financial statements in every business are the Balance Sheet and the P&L or Income Statement. In the allegory of the profit tree, the profit tree value is in the roots represented by the Balance Sheet with the results produced by the trunk and crown of the tree best seen in the P&L Statement as follows:

A business’s Statement of Cash Flows provides a comprehensive picture of the company’s cash flows, beyond operations, to show how cash changes from the beginning to the end of a period. This third financial statement is your summary of the actual, or anticipated, incomings and outgoings of cash over an accounting period (month, quarter, year). While this financial statement has meaning, it isn’t used like your P&L Statement and Balance Sheet to measure the value of your business.

The size of your financial gain is proportionate to the connective power of your trunk and the protective influence of your bark

The trunk of a tree is key to understanding how a tree works. Its primary purpose is to connect the leafy crown of the tree with its roots. The inner core of the trunk is dead wood that supports the tree, referred to as Heartwood. As a tree grows, older xylem cells in the tree’s center become inactive and die, forming new Heartwood.

Sapwood or Xylem is the youngest layer of wood that transports water and minerals up the tree from the roots to the branches and the leaves. This allows the leaves to obtain water and nutrients necessary for the manufacture of food from light energy (photosynthesis).

Food made in the leaves is then transported down to the roots and other parts of the tree for growth through the Phloem’s inner bark. The Phloem carries nutrients and sugar from leaves down the tree to its branches, trunk, and roots.

Cambium is the growing layer of the trunk that is only one to two cells thick. It makes new cells that eventually become part of the Phloem, Xylem, and Cambium during the growing season. The Cambium is what makes the trunk, branches, and roots grow larger in diameter.

The outer bark of the tree protects the tree from injury, disease, insects, and weather. A tree’s bark is like our skin. If it comes off, it exposes the inner layer of live tissue to disease and insect infestation. Unlike our skin, tree bark does not grow back. A tree will heal around the edges of the wounded bark to prevent further injury or disease, but it will not grow back over a large area.

In equating the profit tree to your business that exists to generate profits that turn into greater Owners’ Equity, it’s essential to appreciate how the owner and their management team represent the trunk, and the bark embodies your culture.

The actions and inactions of your management team are key to understanding how your business works. The primary purpose of management is to use the assets of your business represented by your roots, fuel the crown of your business, consisting of sales, operations, and financial management of your business in service to your customers at a profit.

The actions and inactions of your management team are key to understanding how your business works. The primary purpose of management is to use the assets of your business represented by your roots, fuel the crown of your business, consisting of sales, operations, and financial management of your business in service to your customers at a profit.

Cash is the equivalent of the water and nutrients necessary for manufacturing food from light energy (action) that can be sold for a profit. The effectiveness of your cash management is what transfers the water and minerals up the tree from the roots to the branches represented by the people in your business; the leaves reflect the actions your cash pays to have completed.

Profit is the food made in the leaves transported down to the roots representing the business’s assets and to other parts of the tree as growth investments. The more profits you produce, the bigger your business becomes just as, the healthier a tree is, the faster the trunk, branches, and roots grow larger in diameter to accommodate the growth of more fruit.

The culture of a business is seen in shared values, attitudes, standards, and beliefs that shape how people work in a business. Culture is rooted in the values, goals, strategies, structure, and approaches of a company to its employees, customers, investors, and the greater community. As such, it is a defining component in any business’s ultimate success or failure. Like the outer bark of a tree protects the tree from injury, disease, insects, and weather, a strong culture protects a business from outside forces attacking the business and is a catalyst for making more money.

Just as when a tree’s bark comes off, it exposes the inner layer of live tissue to disease and insect infestation. When your cultural norms are violated, your business is exposed to dysfunction and losses. Like bark, damage to your culture does not heal the damaged area. It will heal around the edges of the wound, but it will never be fully restored where the damage has been done.

Any business is only as strong as the root system that nourishes and supports the business

The primary function of tree roots is to absorb water and nutrients into the tree. Through the root system, water and minerals are taken to sustain the life and health of a tree. The taproot is the long main root that anchors the tree and absorbs water and nutrients from deep in the soil. It and the other deep roots are the anchors in the soil that support the tree.

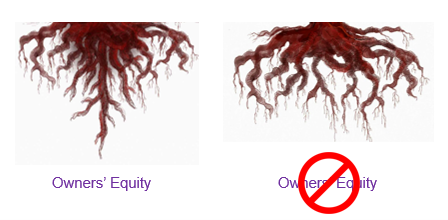

The lateral or shallow roots are smaller roots near the surface of the soil. These roots exist to absorb moisture from rainfall and irrigation quickly in support of the tree. A business with only lateral roots and no taproot is a business that has no Owners’ Equity.

Negative Owners’ Equity happens anytime the Liabilities of a business exceed the value of its assets. To protect this from happening to your business, it is crucial to appreciate the core components of your balance sheet as represented in the root system of a tree.

The Assets of your business represent the capital deployed to generate profits and cashflows. Asset values reflect asset cost, book value, market value, or residual value. Asset values are shown on the Balance Sheet, classified according to the ease with which each asset can be liquidated or converted into cash.

The Liabilities of a business are defined as the legal, financial debts, or obligations that arise during business operations. These values represent the claim against the assets of a business arising out of past or current third-party financing transactions or actions.

The shallow roots of an apple tree represent the Current Assets and Liabilities of the business.

- Current Assets include cash, inventory, marketable securities, and enforceable claims against others, such as accounts receivable. They are used to fund day-to-day operations and pay ongoing expenses.

On a balance sheet, current assets are displayed in order of liquidity; that is, the ease with which they can be turned into cash in less than one year. No business can operate without current assets. These assets are continually flowing in and out of a business through the ordinary course of business operations. For example, cash that is converted, first into goods, and then back into cash.

- Current Liabilities represent the debts or obligations due within one year. They include short-term debt, accounts payable, accrued liabilities, and other similar debts. The impact of current liabilities on your business is proportionate to the amount of cash collected from your sales.

As long as cash flows into the business like a well-managed irrigation system, your business is safe from failure. If you rely solely on rain to water your profit tree because you don’t irrigate, then the first drought that comes along your profit tree is in serious trouble.

Every business is at risk anytime cash outflows associated with Current Liabilities are close to exceeding cash inflows associated with Current Assets. You protect your business from dying by avoiding any additional debt that you are not adequately capitalized with cash reserves to meet near-term obligations and to handle downturns and emergencies that may arise.

The deep roots of a tree are the equivalent of your Fixed Assets and Long-term Liabilities of the business.

- Fixed Assets or Long-term Assets include furniture, equipment machinery, vehicles, land, and building. They can also be a right to use, such as copyright, patent, trademark, or an assumption, like goodwill.

Fixed assets enable their owner to carry out operations. As any fixed asset with long-term value is used, the value of that asset decreases. The annual decrease in value is expensed as “depreciation,” so the current estimated value of each fixed asset is reflected on the financial statements through accumulated depreciation calculated by deducting depreciation from the purchase price.

- Long-term Liabilities are financial obligations or debts incurred and paid back over more than one year from the Balance Sheet date. Long-term debt restricts your monthly cash flow in the near term. The higher your debt balances, the more you commit to paying on them each month. Debt repayment limits your ability to build up a safety net of cash savings to cover unexpected business costs and make new investments to grow in your business.

A healthy tree is represented by a balanced root system with a deep taproot. If your business is solely reliant on shallow roots, you run the risk of the tree’s crown outgrowing the root system. The first big wind that comes along and your tree will topple if you have only shallow roots. If you have only deep roots and a weak, shallow root system bringing in predictable cash flow, then you’re at risk of losing financed assets through repossession anytime you fall behind in your liability payments.

The most important part of the tree is the part not seen, the roots. Roots provide the necessary nutrients for the tree itself, without which, the tree would not get nourishment or water. The tree depends on the roots for feeding it and making it grow.

If you want to own a business that generates higher and higher financial returns, you need to manage your Balance Sheet just like you would nurture the roots of an apple tree to ensure it produces a healthy crop of apples year after year.

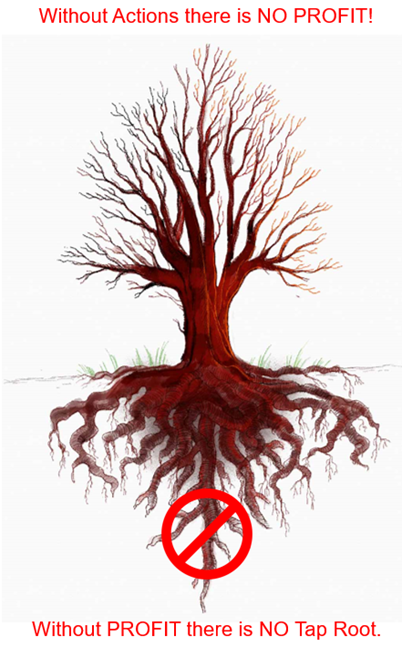

Nothing good in your business will ever happen without the right actions

The definition of right action is any action that contributes to a business earning a profit. Without the right actions, there is no profit. Without profit over time, there is no taproot, as represented below:

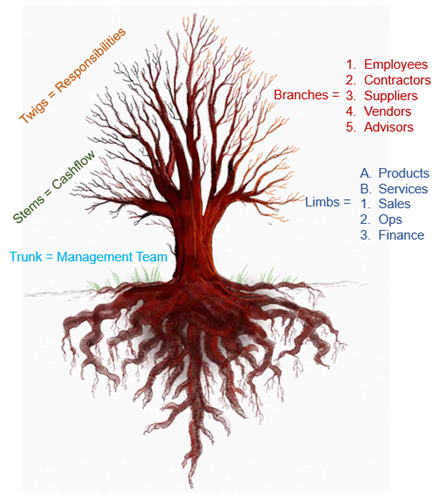

The branches that grow out of a tree trunk form the crown of the tree that the leaves, buds, and fruit grow on. In the allegory of the profit tree, the branches represent the groups of people that work directly in your business or have a significant influence on the success of your business. Below are the five major groups of people associated with every business:

- Employees are people who have been employed for wages or salary to perform assigned duties. As their employer, you are responsible for withholding income tax, Social Security, and Medicare from wages paid.

- Contractors are independent people contracted to perform specific work or provide a service to a business as a nonemployee. No employment taxes are withheld from the contractor payments.

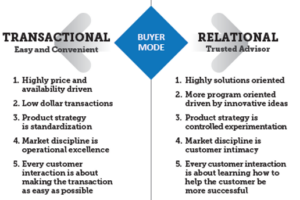

- Suppliers employ people who provide strategically essential goods and services to a business. They are valued for going above and beyond in working with the business. They do this because of the significant relationship that exists between the supplier and their customer.

- Vendors also employ people who offer goods or services for sale. The difference between a supplier and a vendor is a vendor only cares about getting paid for the completed transaction. They don’t help their customer’s businesses be more successful, whereas a supplier offers ideas and insights to help their customers use their product or service more cost-effectively. They do this because they know the more profitable their customers are, the more they will buy from them.

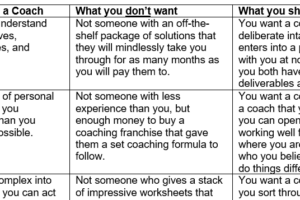

- Advisors are people who give advice to a business in a specialized field or perform a very narrowly defined body of work, such as lawyers, accountants, bookkeepers, and consultants.

The tree’s limb is a significant appendage of the tree arising from the trunk, comprised of the main branches. In the allegory of the profit tree, the branches of the tree represent people attached to the limbs of the tree that represent the primary functions of a business, as shown below:

- Products are what a business offers for sale made at a cost and sold at a price.

- Services are intangible products made up of work performed expertly at a price.

The products a business offers for sale are tangible items that they put on the market for acquisition, attention, or consumption. A service is an intangible item that arises from the output of one or more individuals for the customer’s benefit.

Every business will offer some combination of products and services. The critical point in the allegory is that you must be deliberate in what products or services you offer based on customer demand and your cost to provide. This is why they represent two of the most critical areas of a business. The other most important areas are the core functions that exist in every business:

- Sales activities focus on getting work for a business from generating a lead to converting that lead into a retained customer.

- Operation activities deliver the work through the assets of the business used to produce and distribute the products and services being purchased by the customers.

- Finance activities enable work. This business function will involve human resources, accounting, financial management, and administrative services of the business.

The tiny branches of a tree are called a twig. The twigs of business represent the associated people responsibilities for performing work in your business. They are the specific tasks or duties you expect the people you pay directly or indirectly to complete according to their role. Responsibilities are the specific activities or obligations for which individuals are held accountable when they assume—or get assigned—a role.

Nothing good happens in a tree without stems nor in business without cash

The stems of a tree are the second of the two main structural axes of a tree, the other being the roots. Stems support a tree’s leaves, blossoms, and fruits through their ability to transport fluids between the roots and the shoots in the Xylem and Phloem. The stems also store nutrients and produce new living tissue. The equivalent of stems in your business is cash flow

Consider how the stem is divided into nodes and internodes just as your cash is divided into cash inflows and cash outflows. The nodes hold one or more leaves and buds that can grow into branches with leaves and fruit, and the internodes distance one node from another.

The cash inflows into your business are what enable you to make payroll, pay your subs, suppliers, vendors, and yourself. Cash inflow is the nodes of your business that holds everything together, and your cash outflows are your internodes. Just as an internode establishes the distance between one node and another node, your cash outflow distance from your cash inflows represents the stability of your business. Now consider the four main functions of a stem and how similar they are to the cash flowing through your business:

- Support for and the elevation of leaves, blossoms, and fruits. The stems keep the leaves in the light and allow the plant to keep its flowers and fruits.

- Transport of fluids between the roots and the shoots in the Xylem and Phloem.

- Storage of nutrients

- Production of new living tissue. Stems have cells called meristems that annually generate new living tissue.

Cash inflow is what keeps your business operational, and cash outflows are what keep people coming back to contribute to your business. Cash reserves are the equivalent of soring nutrients for your business, whereas cash surplus is how you invest in new business opportunities. Below is how the limbs, branches, and twigs, form out of the truck of your business that is fed by the stems and roots managed by you:

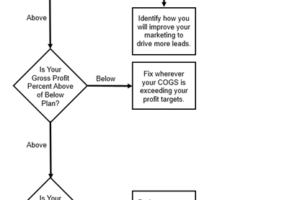

The importance of the right actions to an entrepreneur earning a financial gain from their business ownership is reflected in the following image:

Leaves are the primary way plants interact with the atmosphere in making food. They do this by taking in atmospheric CO2, soil water, and light energy to make simple sugars through photosynthesis. Each leaf performs three main functions: first, they manufacture food. Second, they facilitate the interchange of gases between the atmosphere by breathing in carbon dioxide and breathing out oxygen. Third, leaves evaporate the water. Without leaves, a tree will become unhealthy, stop growing, and eventually die.

In the allegory of the profit tree, the leaves are the actions performed by the people who touch your business. When the actions of your people produce the right results, you make money. When the required actions aren’t done, or they are done poorly, you lose money. The right actions matter because actions produce results. Without actions, there is no profit.

Now consider all that goes on in a business to enable and pay for the different actions performed throughout a year by the people touching your business:

You acquire assets to anchor your business and incur liabilities as you operate your business. Assets, liabilities, and equity exist as investments in the various ways the people associated with your business are used to help you generate revenue. Your cash inflow from sales payments collected is what enables you to pay for the completed actions through your cash outflows. The ultimate question is whether the revenue turned back into cash is at a profit or not?

Without buds, blossoms, and pollinators, a healthy apple tree will not produce apples

Before you get confirmation on whether a sale earned you a profit or not, you first have to complete the sale. A completed sale has its start in a person who is interested in the product or service you sell. A person interested in what you do is called a prospect or a sales lead.

The equivalent of a sales lead in your profit tree is a bud. A tree bud is the stem’s primary growing point. Buds contain stored energy in nutrients and sugars for the growth of leaves or blossoms, just as a sales lead stores cash inflow potential in their purchases from you. Companies generate leads from various sources then follow up with each one to see if the business lead is a good fit for what they sell.

Blossoms are the flowering part of the tree that can form the fruit of the tree. To become fruit, the blossoms must be cross-pollinated, generally by bees and other insects to become fertilized. Once fertilized, the blossom falls off, allowing the ovary to grow and expand into a fruit.

Premature loss of blossoms is primarily caused by improper irrigation. Fruit trees in the blooming stage require exceptional attention in connection with soil moisture. If the tree stresses for water during the blossoming phase, it will produce less fruit. The same truth applies to anytime you stress for cash in your business; less profit will be produced.

The equivalent of the blossom in your business is a sell. Put another way, not every lead represented by a bud converts into a blossom, nor does every sell made result in profits. The primary purpose of the blossom is fruit reproduction, just as the primary purpose of a sale is to earn a profit.

Without pollination, fruit trees would not bear fruit. Cross-pollination of apple trees occurs through the help of honeybees, mason bees, and bumblebees, the primary pollinators of apples. The smell and color of the flower signal to bees; there is tasty nectar waiting inside.

The equivalent of pollinators to your business are outside influencers. The primary external factors that can impact the success of your business involve the government, competition, economic environment, social, legal, and technological changes.

Just as most apple trees are self-incompatible, that is, they do not produce fruit when pollinated from a flower of the same tree your business can’t operate in a vacuum without being influenced by external factors. An apple tree must be cross-pollinated to generate fruit just as your business profits are influenced by your ability to capitalize on the positive while minimizing the harmful external factors happening every day to and around your business.

As we have seen through the allegory of the profit tree, there are several elements at work to convert an apple seed into an apple tree that produces delicious apples for fifty to eighty years. The same is true for your business, particularly as it relates to the importance of buds representing leads, blossoms equating to sales, and the impact of outside influencers acting as pollinators in your business’s ability to generate profits represented by harvested apples as shown below:

Put another way, “Nothing happens until a sale is made.” (Thomas Watson, Sr., president of International Business Machines from 1914 to 1956.) While you may be the hardest working small business owner in the world, it isn’t until a sale is made at a profit that you get to increase your Owners’ Equity.

You maximize your financial gain when you have every business element working together just as they do in a healthy apple tree. Fail to manage the roots and the crown of your business effectively, and you will make less money. Run out of cash because you allow the crown of your business to grow faster than the roots can sustain, and you will go out of business.

How healthy is your root system?

If you want confirmation on how well you manage your business, click here to take the “free” BusinessCPR™ Business Assessment to learn how healthy the roots and crown of your business are.

Upon completing this no-obligation assessment, you will receive a profile showing how healthy your roots are and what your profit potential will likely look like over the next three years.

How healthy is your root system?

If you want confirmation on how well you manage your business, click the link below to take the “free” BusinessCPR™ Business Assessment to learn how healthy the roots and crown of your business are. Upon completing this no-obligation assessment, you will receive a profile showing how healthy your roots are and what your profit potential will likely look like over the next three years.

TAKE THE TEST