Synopsis

If you can’t project how your cash moves in and out of your business, how do you identify what management actions you must take in the weeks ahead? Failing to project your cash in and outflows rob you of the ability to manage your business proactively, leading to reactive, not proactive, management practices. When this happens, you will never have enough money to do what you need, let alone want to do.

It is never enough to manage your business out of your bank account nor by your monthly P&L Statement or your cash position at the end of each month’s bank reconciliation to determine how your business is doing. Too much time elapses between each of these activities. Those who consistently make more money use their cash management process to identify what management actions they need to take in the weeks ahead.

The purpose of a structured cash management system is to identify and project all cash movement in and out of the company by week, over a four, eight, twelve, or fifty-two-week period. Below are four fundamental management principles that will lead to better small business cash flow management:

- Business control begins with proactively managing cash flow timing and amounts.

- Daily cash flow projections rob you of time to improve the quality of your cash flow.

- Being more interested in your topline often leads to a loss of sight to your bottom line.

- Projecting your weekly ending cash position is like monitoring your blood pressure.

Business control begins with proactively managing cash flows.

“Control” over cash implies critical thinking and decision-making by management in how to best use every dollar of cash. This process starts with understanding how cash is collected and paid out to have more cash remaining in your business than you are paying out.

Business owners gain control over cash flow by following the money through week-to-week cash forecasting. This practice projects the timing of cash flowing into and out of the business. Knowing when cash is coming in and when cash will be needed to fund operations is the only effective way to disburse your money prudently.

Failure to manage your cash flows results in the cash flowing through your business to look like the following image – money going everywhere because it is undirected and unmanaged.

Daily cash flow projections rob you of time to improve the quality of your cash flow.

The hardest part of cash management is forecasting the amount of money coming available for disbursement each week. For practical purposes, daily cash projections are too often and will rob you of quality time that could be used to improve the quality of your cash. Cash quality equals profits, and cash from profits is the cash that matters because it’s the cash that you get to keep, not the cash that flows through your business.

Being more interested in your topline often leads to a loss of sight to your bottom line.

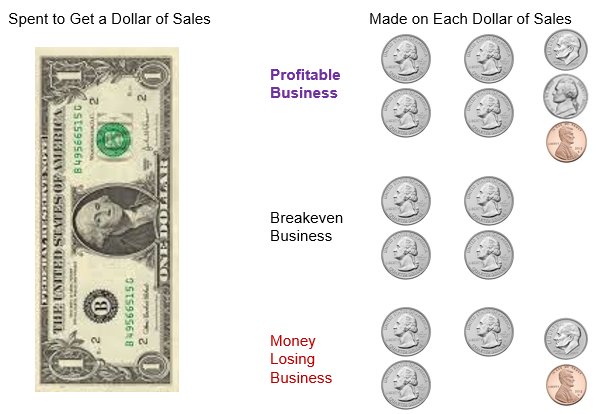

Businesses with poor cash quality are typically businesses with high sales and low profitability. Any business trading the equivalent of a dollar for four quarters is a business that’s break-even at best. Business owners in this position are either continuously anxious about cash or clueless.

When you are prouder about how much you are selling than you are about how much you are making on each sale, you put your business at risk. It is vital to long-term business survival that everyone in a business appreciate that long-term business success comes down to the money held onto, not how much product is sold. Business owners who don’t understand this concept are the most difficult to help.

In contrast, the owner who is anxious about their cash and its flow, management, and quality is an owner that can prosper during good times and survive the bad. To put this difference in attitude in medical terms, these forward-looking owners are like those who change their diet and lifestyle after learning they’re at increased risk of a heart attack. They follow their doctor’s instructions to eat less, cut out alcohol and cigarettes, start exercising and monitor their blood pressure.

Projecting your weekly ending cash position is like monitoring your blood pressure.

Just as you gain control over your blood pressure by following your doctor’s orders, you gain control over your cash velocity and, ultimately, your cash quality by managing your cash position week to week.

A useful cash management tool will help you calculate how much cash you are likely to have on hand at the end of a week. You start by adding to your beginning cash position the forecasted cash inflows you anticipate to receive. These monies represent your cash inflows. You then lay out what cash you plan to pay out to employees, lenders, subs, and vendors weekly. These monies represent your cash outflows. The law of cash management is that cash inflow must be higher than cash outflow.

If you find yourself with little to no gap between your cash outflows and your inflows, that’s the equivalent of your doctor telling you that your blood pressure is too high. Left uncontrolled, high blood pressure damages arteries that can become blocked and prevent blood flow to the heart muscle leading to a possible heart attack.

How healthy is your business?

Your business can suffer the equivalent of a heart attack when your cash outflows are consistently too close to your cash inflows. Take the “free” Business Fitness health check to learn how at risk your business is to suffering business cardiac arrest. Click the link below to take this no-obligation business fitness test.

Upon completing the business fitness test, you will receive a risk profile showing how at risk your business is to suffer cash flow and profit problems, the primary cause of business cardiac arrest over the next three years.

How healthy is your business?

Your business can suffer the equivalent of a heart attack when your cash outflows are consistently too close to your cash inflows. Take the “free” Business Fitness health check to learn how at risk your business is to suffering business cardiac arrest. Click the link below to take this no-obligation business fitness test. Upon completing the business fitness test, you will receive a risk profile showing how at risk your business is to suffer cash flow and profit problems, the primary cause of business cardiac arrest over the next three years.

TAKE THE TEST