Synopsis

It’s impossible to hold people accountable for results if you fail to delegate the necessary authority to accomplish what you are holding them accountable to achieve. If you are making all the decisions on what and how to do things, then accountability for the result of the actions you delegate remains with you. All you can do is hold them accountable for doing what you told them to do.

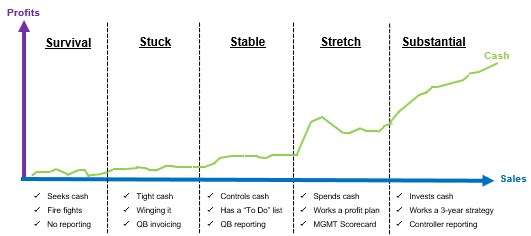

One of the most common obstacles to people being accountable for results involves the failure to delegate the necessary authority to accomplish what they are being held accountable to achieve. Businesses that find themselves in the survival, stuck, or unable to get out of the stretch business profit progression stage are there because their owners aren’t good at empowering those in management and supervision positions to own their role.

The primary reason for owners not to delegate the required authority and responsibility to others in their employ is because of their fear of that employee failing. It is you, the owner, not your employee that has everything at risk. Mistakes cost money, and when money is tight, it’s hard to let go of authority and responsibility for decisions and actions that can put you out of business, so don’t.

Your obligation to your business is significant. You honor your obligation by being clear on what you alone are the best at doing and not let go of any accountability or responsibility for these business-critical decisions and actions. Below is a list of the most common business accountabilities for a small business owner:

|

Small Business Owner |

| 1. Profit Plan Management

2. Sales, Ops, Finance, and HR Policies 3. Cost, Expense Policies 4. Asset Management 5. Risk Analysis + Insurance 6. Marketing Promotions 7. Corporate Accounts 8. Tax Management 9. Community Involvement 10. Professional + Financial Services Relationships 11. Vendor and Subcontractor Relations 12. Facilities Management |

As your business grows, you are likely to delegate many of the above responsibilities, yet you will always remain accountable for how your business performs against the following business equations:

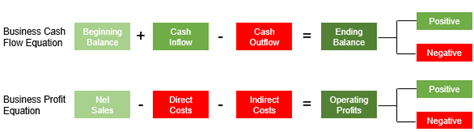

The better your track record for keeping your business cash flow and profit equations positive, the less involved you will be in the day-to-day work tied to your accountabilities. Anytime these core business equations go negative, you are likely to reengage quickly because no business owner wants to lose money in their business.

Below is a side-by-side comparison of the typical accountabilities associated with sales, operations, and finance. In the start-up phase, ownership will be highly involved across all three of these business areas. As you bring in managers to help you control your business, you will let go of some of these responsibilities.

|

Sales |

Operations |

Finance & Administration |

| 1. Sales Process Management

2. Sales Quotas and Targets 3. Prospecting 4. New Business Development 5. Bid Prep + Submittal 6. Sales Contracts 7. Customer Relationship Management 8. Customer Follow-up 9. Develop Referral Base 10. Sales Activity Reports 11. Revenue Forecasting 12. Sales Policy Compliance |

1. Operations Process Management

2. Operations Standards + Quality 3. Ops Productivity & Efficiency 4. Job Tracking 5. Equipment Utilization 6. Material Evaluations 7. Operational Reports 8. Material + Inventory Control 9. Safety Standards + OSHA Requirements 10. Operations Policy Compliance |

1. Customer Relations + Service

2. Work Orders + Job Scheduling 3. Cash Flow Management 4. A/R, A/P, G/L Management 5. Sales + Operation Reports 6. Financial Strategies, Analysis, + Reporting 7. Invoicing, Credit, + Collections 8. Payroll 9. Bank Reconciliation 10. Human Resources 11. Computer Services 12. Licenses and Registration |

The question to ask yourself as you delegate each of the above responsibilities is: “Am I going to delegate the accountability for the result as well, or am I going to hold onto that?” If you want to be accountable for specific results, you are delegating responsibility for the actions to be performed because not the authority for the actions you are holding onto.

Actions with only responsibility but no authority means that all you can do is hold your responsible manager for doing the action or not. You can’t hold them accountable for the results of a responsibility if you don’t give them the authority to shape the actions required to produce the plan result.

Don’t bypass the chain of command unless it is life or death

Another common problem in delegating authority is the direct issuance of instructions by an owner to personnel under a manager’s span of control. Doing so undermines the manager and effectively destroys their authority; simultaneously, it diminishes their feeling of accountability for achieving results. Accountability, or who owns the results, rests with the person making the decisions and issuing orders.

It’s never a good situation whenever you feel you have to step in to direct the subordinates of another manager. It is better to remove a manager you have to constantly step in for from a management role if you are not prepared to extend them the following considerations:

- Each manager must have defined accountability and authority over all personnel, equipment, and facilities for which they are accountable for achieving specific results.

- Each manager must have the full support of their manager whenever an employee is judged unsatisfactory and must be transferred or terminated.

- Each manager is expected to develop and maintain a high standard of morale and production. Consequently, they must be thoroughly familiar with all company policies and feel supported when they correct for policy and practice infractions as they arise.

- Each manager is expected to make recommendations concerning subordinate employees. Be clear with them who has the authority to hire, promote, demote, discipline, or terminate any employee under their authority, so there is no confusion.

Being accountable for results or not touches everyone

Delegating authority is difficult. It is particularly difficult when a business is struggling with tight cash flow and low profits. Delegating management authority transfers the power or right to give orders, make decisions, and enforce obedience over their responsibility from the owner to their employee.

Every employee, regardless of title or function, has a responsibility to be accountable for themselves and the activities they have been assigned to complete. Each person in your employ must complete the work they are accountable for performing if you are to earn profits. Failure to complete assigned work will almost always lead to losses.

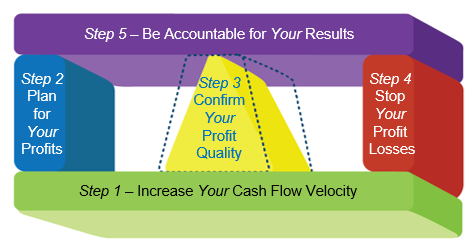

You position your business for success by being clear on who is accountable for what by when. The Business CPR™ Management System presents an easy-to-apply five-step system to master the relationship of cash to profits through your business’s financial reports. Understanding this relationship with confidence is the best way to identify what you can and can’t delegate in your business.

Knowing the relationship of cash to profits through understanding your financial reports is how you hold you and those you delegate authority to accountable for the results being generated through your business. Never lose sight of the simple truth that B-CPR Step 5—Be Accountable for Your Results is the step that will most effectively help you to avoid business cardiac arrest altogether.

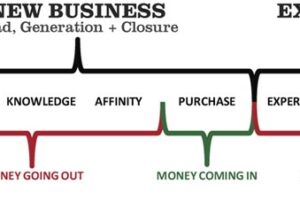

Without deliberate action on the critical few things needing to be done, you will never produce your desired results. Every business starts with cash, which is invested in various ways to generate revenue. Ultimately, the revenue is turned back into cash, and the cycle begins anew. There comes the point in your business when you can’t manage the following cycle by yourself.

The good news is each completed business transaction produces data that forms the financial reports used by your accountant to calculate your financial position for tax liability purposes. You use these same financial reports to hold those with delegated authority accountable for the results they produce. You do this to own a business that is continuously generating positive operating cash flows and a sustainable net income.

BusinessCPR™ not only protects your business from failing when actions don’t produce the desired results; it’s the surest way to realize your sales, profit, and wealth creation goals.

What is your biggest problem?

If you aren’t clear on where your business needs the most improvement and your role in managing your business to higher profits and more consistent cash flow, click the link below to receive a free review of the three most important areas of improvement for your business.

What is your biggest problem?

If you aren’t clear on where your business needs the most improvement and your role in managing your business to higher profits and more consistent cash flow, click the link below to receive a free review of the three most important areas of improvement for your business.

FREE ASSESSMENT