If you lead a business that faithfully records its business transactions in the proper chart of accounts in its accounting software on a timely basis, you have the building blocks it needs to create a business intelligence system (BIS) to help it make better decisions.

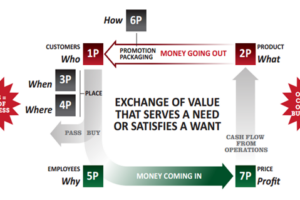

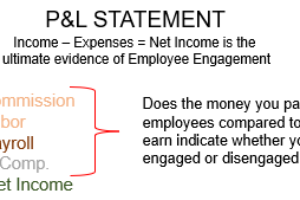

The cornerstone for every business shaped by a BIS is its financial statements. An accurate P&L Statement and Balance Sheet readily informs on the quality of the decisions management have already made and the actions they have already taken. It doesn’t matter that the numbers reported here are lagging, not leading indicators of results. What matters is they confirm the results of business investments as shown here.

The management technique for making your financial statements a source of business intelligence starts with working backward to identify the necessary actions that need to be completed to realize the planned/desired results. Knowing what actions need to occur is how you identify the leading indicators you will need to act on to realize your planned results.

Leading indicators are often related to activities undertaken by employees with lagging results, telling you the profitability of those activities. Failure to monitor the appropriate actions and activities on a daily and weekly basis robs you of the opportunity to take a more informed path to make more money.

Highly profitable businesses use their BIS to confirm how they are doing through the year by identifying where it is performing better and worse than planned, utilizing the following tools:

KPI Scorecard: Comprises your leading metrics or key performance indicators (KPIs), which should be captured and discussed in your weekly management team meetings. Using a KPI Scorecard helps you confirm that your daily actions are on track to produce your planned weekly, monthly, and annual results.

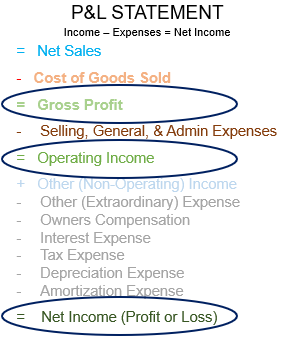

Financial Statements: Are your financial summary reports on the results of business operations. The P&L Statement shows how the net income of your business is determined. The Balance sheet shows your assets, liabilities, and net worth on a stated date. The Statement of Cash Flows shows the sources of cash utilized by your business activities during a stated period. Each financial statement shows how the funds entrusted to management by the owners’ and lenders led to the current financial position.

Variance Reports: Are pulled from your monthly P&L statement and balance sheet. They should be used during the second management meeting of each month to confirm whether or not you realized your planned results for that month.

The information in these management reports comes from data generated and recorded through every transaction. If you capture this data accurately and on a timely basis, you will be able to convert it to information to identify the needed actions you must take to position your business to make more money.

Leading and lagging metrics measurement that confirms the quality of your results is business intelligence. It is how large businesses know if their business is on track to make money before it’s too late. The failure to use this available intelligence is why small businesses remain small.

As you confirm the quality of your actions through weekly KPIs (key performance indicators) and the quality of your results through KRIs (key results indicators) and monthly variance reports, you’ll establish where your business is on track. You’ll also identify where you are not tracking to meet your profit plan goal. Think of it as a simple equation where “actions = results.”

Note that profit plan goals can and do overlap with strategic goals, whether or not you have a strategic plan mapped out. What’s important is using your leading and lagging metrics in tandem to track the progress of your activities from start to finish, through to the final results reported on your P&L Statement and Balance Sheet.

Get help putting your transaction data to work

Click here to talk with a BusinessCPR™ Business and Financial Reporting expert to learn how best to start applying the benefits of business intelligence to your business.