Cash availability is a critical aspect of any business’s financial health. Without sufficient cash flow, a company will struggle to meet its short-term obligations, invest in growth, and navigate unexpected challenges anytime the following exists:

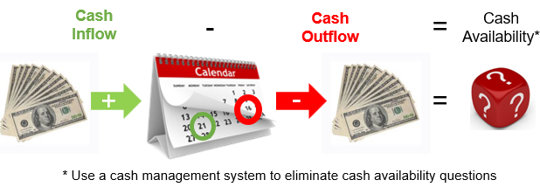

Cash availability represents the timing and amount of the cash flowing in and out of a business.

If your business battles poor cash availability, it’s crucial to take proactive measures to increase cash inflow while slowing down cash outflow. Below are ___ key strategies to enhance cash availability to get you into the next week, month, and year:

- Cash Flow Analysis: Identify the root causes of poor cash availability. Track and categorize all cash inflows and outflows, including receivables, payables, operating expenses, and debt repayment. Pinpoint areas where cash is being tied up or drained and develop a comprehensive understanding of your cash flow patterns. Click here to access the BusinessCPR™ Cash Management Basic Tool

- Cut Unnecessary Expenses: Use your cash flow analysis to act on identified areas you need to cut beginning with unnecessary expenses. Eliminate redundant processes, enter into contracts with vendors, and encourage cost-conscious behavior across the business. Every dollar saved contributes directly to improved cash availability. Click here to learn how to ncrease business profits from cash flow in five easy-to-apply steps.

- Accelerate Cash Inflows: Implement strategies to accelerate accounts receivable collections. Encourage customers to make electronic payments, offer online payment options, and issue invoices promptly and accurately. Improving accounts receivable turnover can have a significant impact on cash availability. Click here to access the BusinessCPR™ A/R Collection Process + Toolset

- Tighten Credit Terms: Reevaluate the credit terms you have extended your customers to expedite receivables. Require down payments and deposits for work to be performed. Offer discounts for early payments while implementing more stringent credit policies for customers with a history of late payments. Click here to learn how to STOP being your customer’s bank.

- Renegotiate Payment Terms with Suppliers: Contact your most important suppliers for help. If you are a valued customer, they are likely to extend the time available to settle payables. This strategy provides a cash buffer to help you manage your working capital more effectively. Unfortunately, this option only works if you have put in the effort to have strong supplier relationships. Those who value you are likely to extend mutually beneficial terms. Those you abuse rarely do.

- Short-Term Financing: Consider short-term financing options to bridge cash flow gaps. Short-term loans, lines of credit, or invoice financing can provide a temporary cash boost while you work on optimizing your cash flow. However, exercise caution and only take on debt that you can comfortably manage. Click here to learn if this is a viable option for your business.

- Cash Forecasting and Budgeting: Implement disciplined cash flow forecasting and budgeting processes. Accurate cash flow projections help you anticipate cash availability issues and take proactive measures. Use a profit plan to establish operating budgets to ensure financial discipline and prioritize cash preservation. Click here to set up a cash management system.

A healthy business has consistent access to cash, especially when the economy takes a turn. Analyzing your cash flow, cutting unnecessary expenses, collecting payments faster, and negotiating better terms with suppliers can all help. The problem is they are all reactive management actions when cash is tight.

What’s needed is disciplined cash management practices that help you forecast your cash inflows so that your cash outflow never exceeds your cash inflows. The key to cash availability and peace of mind is number seven above. By mastering this skill, you can survive the unexpected.