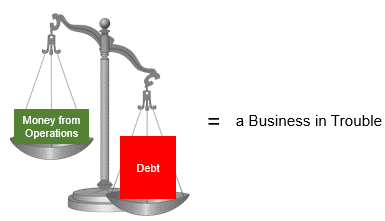

You know you have too much debt if you cannot save money, are continuously late in your bill payments, and are always scrambling for money to get into the next week.

Your debts are too high if you are constantly juggling your cash—it’s time to look at ways to improve your profitability and cash flow to reduce your debt burden.

Overview

Debt creates financial leverage. It allows you to acquire assets in the near term that you have insufficient working capital and equity to acquire.

The challenge with debt always comes down to the ability to repay the debt. Increasing financial leverage means increasing the proportion of Debt to Equity. Solvency Ratios measure a company’s ability to sustain operations, indefinitely, by comparing debt levels with equity, assets, and earnings.

Liquidity is a measure of a company’s ability to meet its near-term financial obligations through liquid assets that can be quickly converted to cash and reported on the balance sheet as cash, short-term investments, current A/R, and inventory. Liquidity ratios are the most widely used ratios. These ratios are used to analyze the ability of a company to pay off its current liabilities as they become due, as well as their long-term liabilities as they become current.

Both of these ratios are important to creditors for their ability to measure a firm’s ability to meet its short-term obligations and turn other assets into cash to pay off liabilities and other current obligations. The results of these ratios are used to measure how easy it will be for the company to raise enough cash or convert assets into cash.

The fastest way to establish if your business debt levels are too high is to take the current assets on your balance sheet and divide it by your current liabilities. If this number is less than 1.0, you are at risk of having too much debt. Your goal should be to have a working capital ratio closer to 2.0. Other early warning signs that your debt levels are too high include the following:

- You have no cash reserves for emergencies.

- You don’t know your monthly expenses.

- Poor business profitability.

- Inadequate financial records.

- You pay your bills late.

- You are regularly charging up to your credit limit.

- You are paying only the minimum amount due on your credit card balances for two months in a row.

- You have been denied new credit.

- You have lost your best people.

- You suffer physical side effects from scrambling for cash as you dodge collection calls.

Generally, too much debt is a bad thing. It inhibits a company’s ability to create a cash surplus. Ultimately it’s not suitable for the business owners who are last in line in their claim against the asset of a company that becomes insolvent.