The higher your cost structure, the more you have to generate in sales to cover your business costs. If you have a high-cost structure and no cash safety net to cover any “surprises,” your business is at high risk of going out of business because you run out of cash.

Correct for this by eliminating all unnecessary costs and reduce those that are too high to lower your average daily cost to do business.

Overview

Your business wins through building on daily success. Your profit or loss is the cumulative result of your daily actions throughout any given time period. You start controlling expenses when you know how much money is flowing through your sales, operations, finance, and administration functions on a daily basis. To more easily stay on top of your cost of doing business, you need to accurately determine your average cost per day to keep your doors open.

If at the end of the day, you have converted a higher share from a dollar of sales into a profit—then you can count that day as a win. If you spent more than you collected, you lost. You won’t start making a profit again until you earn back the lost profit through higher sales and lower costs.

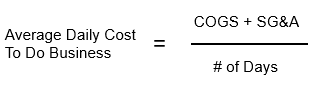

The formula for calculating your Average Daily Cost to Do Business

COGS + SG&A / # of Days

If your average cost per day is $2,400 and you take in $3,000 then you’re $600 ahead. If your next day cost structure doesn’t change, and you only take in $1,700 then you’re down $700 for the day and $100 for the two days because you took in less than you spent.

Lower Creates Opportunity: The less you have in total expenses to pay out of each sales dollar, the higher your bottom-line number.

Higher Creates Challenges: The higher your cost structure, the smaller your safety net, intended to cover any “surprises” that could quickly drain your cash.