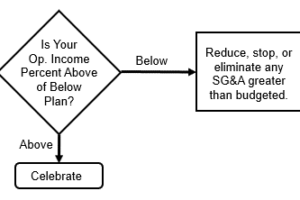

If sales fail to bring in the work and operations are inefficient in doing the work, then finance has real problems. There is only so much overhead they can reduce before you miss your operating income goal.

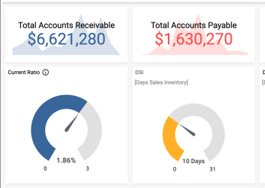

Finance knows the challenges and opportunities ahead if they are helping sales and operations generate their weekly KPI reports. The function of finance fails the business when they don’t keep the management scoreboard current, and they fail to collect the accounts receivable when due. Protect from this by having processes to provide business intelligence and collect the money owed.

Overview

One of the critical roles finance has in the business is ensuring all activity metrics are viewed in aggregate, including Profitability and Efficiency Ratio analysis. Remember that leading metrics are meant to predict and inform what your lagging measures will likely be reported at month-end. When used together, these metrics can effectively communicate your day-to-day business operations’ quantity, quality, efficiency, and effectiveness.

Below are the KPIs finance is accountable for managing to target.

Cash Flow

- Beginning Cash Balance

- Available Cash as a Percent of Target

- Average Weekly Change in Cash

- Total Ending A/R

- A/R balance greater than 60-days

- Collections calls per day

- Total Ending A/P

Investment

- Return on Inventory

- Return on Assets

Debt Exposure

- Days of Liquidity

- Working Capital Ratio

- EBITDA to Fixed Cost Ratio

Once you have identified your KPIs for finance, your next step is establishing a baseline to measure current performance against historical. Do this to measure your progress and gauge whether you are doing better or worse than when you started measuring accounting and financing activities.

Next is setting activity goals to push your sales function to improve. The gap between your goal and baseline is what you will be working close to realizing your cash flow and profit plan Operating Income goals.