Business owners who use their financial statements to help them make informed business decisions refuse to manage their businesses blindly. They know it’s essential for their business to have in place day-to-day routines that enable them to have accurate and timely financial records that give them direct insight into where their business is doing well and where it is underperforming or failing.

Overview

A bookkeeper is accountable for accurately processing, recording, and reconciling the sales, purchases, and payroll transactions. This includes the collection of accounts receivable, payment of bills, and the adjusting of entries before the company’s financial statements are distributed. Larger companies are likely to have accounting and payroll clerks instead of bookkeepers.

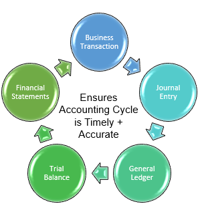

Bookkeepers must be able to work quickly and accurately with accounting software such as QuickBooks or Sage and Excel worksheets. They are critical to the accurate and timely recording of financial transactions as part of the process of accounting. They will assist an accountant in the creation of financial reports, preparing source documents for all transactions, operations, and other events of a business that bring the books to the trial balance stage. Once the trial balance is completed, you can have access to an accurate P&L Statement and Balance Sheet for that reporting period.