Are you satisfied with what was left over after Total Expenses are subtracted from Net Sales for the last month?

If not, what will you do differently today to either increase sales while holding expenses steady or decrease expenses across your business until you can grow sales? Your bottom-line will not improve if you don’t stay on top of your expenses. Every dollar wasted on an expense is a dollar less in profit. The math of business is as simple as that.

Overview

Any cost, also called expense, incurred in a company’s efforts to generate revenue needs to be a contributing cost of doing business, or it should be eliminated.

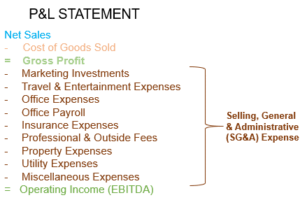

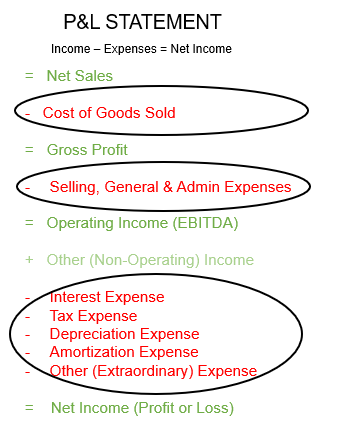

Expenses are summarized and charged on the P&L Statement as deductions from sales income, before assessing income tax. Each business expense is allocated to one of the following three expense categories:

- Direct Expenses are always related to producing the goods sold by a business and are often referred to as Cost of Goods Sold or COGS.

- Indirect Expenses represent the fixed expenses or overhead of the business that cannot be directly assigned to a particular job or product. Most often referred to as SG&A Operating Expense.

- Other Expenses represent costs incurred that are not directly attributable to the company’s core business operations and are considered unusual, infrequent, or extraordinary business expenses.

A business only earns a profit when the above expenses are less than sales. This same business only builds cash reserves when cash inflows are greater than cash inflows. Continue to excel at both at high levels, and you are on the path to achieving financial freedom. Fail to earn sufficient profits that build sustainable cash reserves, then financial freedom through business ownership will never occur.