Gross Sales provides the topline view of the P&L Statement that establishes how well or poorly a business utilizes its capital, capacity, employees, and other resources to generate business. Including Nonoperating inflows of money in your Gross Sales overstates Gross Sales giving you a false number on how well you utilize business assets. Protect this by recording other income in the correct income category.

Overview

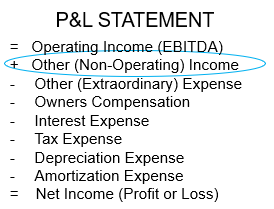

Any inflow of monies from earnings or payments received that is not directly attributable to the company’s core business operations is accounted for here as “Nonoperating Income or Other Income” on your P&L Statement.

Nonoperating income usually does not occur on an ongoing basis and is examined separately from operating income. Income reported here includes gains or losses from investments, property or asset sales, currency exchange, and other atypical gains or losses that are not reflected in gross sales.

Any income generated through the sale of a subsidiary or division would also be accounted for here since the company won’t be able to resell that division again. Such income is a one-time occurrence and, therefore, categorized as nonoperating income.

Congratulations if you have reoccurring Nonoperating Income flows. This means you are generating returns on business investments that are outside your core business. The key to this dynamic is to ensure you are accounting for any expenses tied to this income so you have a true reflection of the bottom-line for your business, as reflected in the image above.