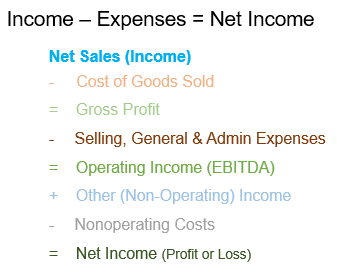

The best summary of management’s performance is your P&L Statement, which, as the name indicates, reflects either profitability or the lack of profits from reported business operations.

Overview

The most effective use of your P&L Statement is in isolating areas where you are at the highest risk of losing money. By studying the areas of direct cost and overhead relative to Met Sales achieved by your business, you see where you are making money and where you are losing money.

Your P&L Statement itemizes the revenues and expenses that led either to your current profit or loss. By looking at the actual numbers produced through your business, you can compare the planned versus actual numbers. The variance, or gap between actual and planned, is the best way to identify where you need to take action to improve future results.

Your Profit Plan establishes what you should make, and your P&L Statement shows you what you did make. A positive difference between actual and plan indicates that you made more money than you planned to make. A negative difference, even if you showed a profit, shows where you lost money by failing to meet your profit plan or rolling 13-month average.

In assessing your P&L Statement, your first assessment goal is determining whether sales generation or expense management drove the bottom-line result.

If your reported Net Profits exceeded expectations, it’s about recognizing what worked well and where you build on it to make more money. If your Net Profit is below expectations, the following next-level actions are recommended:

- If sales came in too low, determine if your problem stems from weak lead generation, poor lead conversion, shrinking average transaction value, or something else? The goal is to know whether you have a marketing or sales problem.

- If expenses come in high, then it’s a question of Operation Management not staying on top of their Cost of Goods Sold, or is overhead too high, then that’s an issue of finance or ownership, allowing SG&A Expenses to be too high. The goal here is to identify where expenses are most out of control and where management needs to intervene to reduce expenses.

Failure to improve the core underperforming area of a business will lead to less money being made. Protect your business by taking quick action to fix either your sales or expense management with your P&L Statement results are unacceptable.