One of the biggest drains on business profitability is keeping direct labor busy on non-revenue-producing work when sales have slowed. Calculate this throughput ratio to see how much this practice costs you.

A ratio significantly below one indicates that your sales aren’t keeping up with your direct labor costs or that you have too much direct labor than your sales can produce. Either way, you are losing Gross Profit because your direct labor isn’t productive at your current sales volume.

Overview

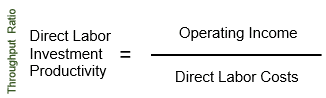

Direct labor productivity is critical to cost efficiency and profitability for most businesses. Direct Labor Investment Productivity is a single-factor Throughput Ratio that measures how efficiently your direct labor investment converts wages, employment taxes, and assigned benefits into useful outputs (Gross Profit). This throughput view is used to determine how much your direct labor contributes to the operating profit of your company.

Most of your employees have been hired to perform the work created by sales that produce profits. This measure tells you how efficiently you manage this talent pool to produce profits during a given period. It isn’t about any one particular direct employee. The more productive your direct labor talent pool, the greater the profit return you’ll earn from your investment in the employees who get the work done.

The formula for calculating Direct Labor Investment Productivity

Output (Gross Profit) / Input (Direct Labor Costs)

A ratio of 1 means that the company is generating 1 dollar of Gross Profit for every dollar invested in a direct laborer. A 0.6 ratio means that $0.60 in Gross Profit is generated for every $1.00 in direct labor compensation paid.

Higher Creates Opportunity: a positive ratio moving up each year usually indicates an upward profit trend.

Lower Creates Challenges: a ratio significantly below 1 indicates that your investment is inefficient in producing Gross Profit.