The function of finance is the caboose at the end of your profit train. Sales are the engine that pulls the train. Operations represent the rail cars that carry the payload, and finance ensures you stay on the tracks to your desired destination.

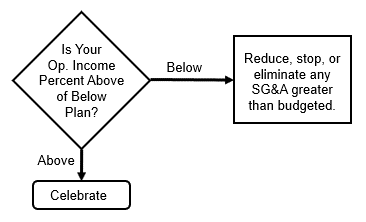

Finance is the function that keeps the score for the business. Their role is to alert the business when sales are projected to change so that operations can adjust appropriately. They protect your Operating Income by ensuring that overhead contributes to business results, not undermine them. Most importantly, they manage your cash to ensure you don’t suffer operating delays because you don’t have the money to fund your business operations.

When the business is performing better than planned, finance gets to help the business owner decide what to do with the profits being generated. Ultimately, this is the goal of finance—to position the owner to make the best decision in business—the decision of what to do with the surplus cash being generated from higher business profits.

Overview

Below are the monthly Key Results Indicators (KRIs) and their respective metric formulas associated with finance and business administration that tell you how well your business is “enabling work:”

Operating Income for Month: Gross Profit – SG&A Expense for the Month

Operating Income Year-to-Date: Year-to-date Gross Profit – YTD SG&A Expense

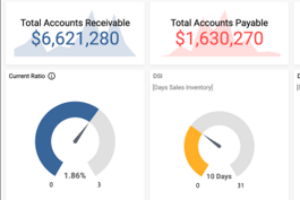

A/R Current: Total A/R that is Current (less than 30-days)

A/R 1 to 30 Days Past Due: Total A/R that is 1 to 30 days past due

A/R 31 to 60 Days Past Due: Total A/R that is 31 to 60 days past due

A/R 61 to 90 Days Past Due: Total A/R that is 61 to 90 days past due

A/R > 90 Days Past Due: Total A/R that is greater than 90-days past due

Average Days Payable: Accounts Payable divided by COGS times 365

Return on Capital Employed: Capital Employed = Total Assets – Current Liabilities; ROCE = Operating Income divided by Capital Employed

Change in Investment Fund: Current account balance less the previous months account balance

Gain on Asset Sales: Amount of Gain or Loss being reported in current month P&L Other Income

Less than an hour a month to review the above measures of performance will confirm where you are making money and where you are losing it across your finance and admin functions.

Business owners who remain stalled in the Survival or Stuck Stage never help their businesses through this simple analysis of their business results. They will learn things about their business by applying these straightforward equations to their financial statements. All that is needed is financial statements they can trust prepared on time to shape the decisions needing to be made for the months ahead.