Yes, arguments can be made that a sale at a loss can be good for a business. Yet, it can never be said that a business has long-term viability if it generates less sales than it incurs in expenses.

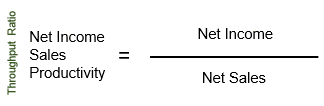

You protect your profits by setting winning pricing policies and controlling operating, overhead, and nonoperating costs relative to Net Sales. Calculating your Net Income Sales Productivity ratio is the easiest way to confirm all this is happening. The higher the ratio, the better you convert sales into profits.

Overview

Net Income Sales Productivity is a Throughput Ratio that is related to the Net Income Margin Ratio. It measures how effectively a company converts sales into Net Income. It’s the best validation of a business’s ability to set winning pricing policies and its ability to control operating and nonoperating costs relative to its Net Sales. It shows what the ratio of sales is after all expenses are paid.

Higher ratios are achieved by generating more revenues while lowering or keeping expenses constant or by maintaining revenues at a lower rate of expenses. A low-profit margin indicates high risk and the possibility that a decline in sales will erase profits and result in loss.

The formula for calculating Net Income Sales Productivity is as follows:

Output (Net Income) / Input (Net Sales)

A ratio of 0.15 means that 15 cents have been collected and held onto for every dollar of sales. A 0.06 ratio means that $0.06 in Net Profit is generated after everyone has been paid for every $1.00 sold and collected.

Higher Creates Opportunity: means that the company is running efficiently, creditors will be paid, and owners will see a return on their investment.

Lower Creates Challenges: indicates that expenses are too high. Management will need to budget and cut expenses to avoid losses.