One of the significant differences between large and small businesses is the routines that large businesses have to help them do what needs to get done. Be it annual, quarterly, monthly, weekly, or daily, large businesses work by several routines to keep everyone aligned and working in the same direction.

Small business owners think they are too busy to take on any cash or profit management routines, so they don’t, leaving them always wondering why they never have any money. Some things must be done in every business. The big businesses recognize this, while the small ones never do.

Overview

A business is sustainable when cash flow from assets results in CashIn being greater than CashOut.

A business is scalable when assets consistently produce profits, where Net Income divided by total Assets results in a Return on Assets, is greater than one.

Business routines with rhythm put their assets to work to improve sales and profits continuously. The best way to have CashIn be greater than CashOut is to have every asset in a business earning a profit. Rhythms in business are defined as a consistent, regular, repeated pattern of action at preset times. Routines involve a sequence of actions regularly performed as part of an established procedure rather than haphazardly.

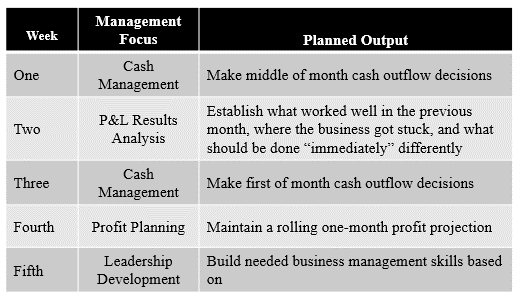

For example, management teams that have a weekly meeting rhythm in controlling the actions of a business are better positioned to build on what’s working and change what isn’t. They keep these meetings from becoming unproductive by adopting preset rotation like the following to the core subject covered each week:

Week One—Cash Management. The meeting goal is to confirm the middle of the month cash outflow decisions and discuss any A/R collection challenges.

Week Two—P&L Results Analysis. The meeting goal is to establish what worked well in the previous month, where the business got stuck, and what should be done “immediately” differently.

Week Three—Cash Management. The meeting goal for this second cash discussion is to confirm the second half of the month’s cash outflow decisions and discuss any A/R collection challenges.

Week Four —Profit Planning. The meeting goal is to update your three-month rolling profit projections.

Since an essential part of staying in rhythm is not skipping your weekly management team meeting routine, the fifth week in a month is focused on Leadership Development. Here, the goal is to pick a management topic involving an area of the business that the business and your employees need the management team to perform at a higher level.

Rhythm and routine build habits that turn into muscle memory, making that which you persist in doing become easier. Most small business owners struggle because they start a new routine only to let everyday distractions break the rhythm, resulting in weeks passing between attempts to build a new habit. When needed routines aren’t adopted, the business struggles to generate sufficient sales to realize the owners’ profits.