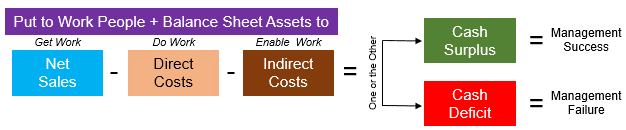

Profit Management combines getting, doing, and enabling work at a profit. If you don’t manage the business to earn profits, you will never have acceptable cash reserves in the bank. Failures in Profit Management make Cash Management a daily activity when cash outflows exceed cash inflows. You keep this from happening by earning profits that allow you to build sustainable cash reserves.

Overview

Profit Management is the organization and coordination of the activities of a business to achieve defined business objectives at a profit. In contrast, Cash Management represents the proactive control over cash receipts dispersed through disciplined control over cash outflows based on accurate cash inflow projections.

No matter how much cash flows through your business, you’ll face internal and external problems outside of your control that will hinder your cash flow if you aren’t generating profits.

If your business suffers more losses than profits, you will quickly find yourself in serious financial difficulties. This is a common occurrence for business owners who fail to understand the differences between cash and profit management.

You need both cash and profit management practices to make money.