Knowing how Net Sales, Gross Profit, Operating, and Net Income are doing year-over-year and actual-to-plan is how you quiet the noise around you and create clarity on what’s working well in your business, where you are getting stuck so you can build on your strengths and take action against what needs to be done differently.

Overview

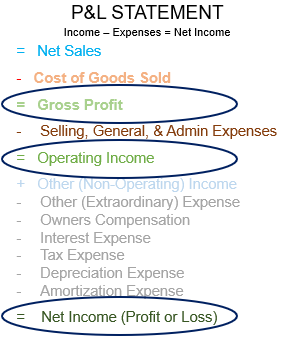

Every business succeeds or fails based on the remaining surplus after total costs are deducted from Net Sales. The “Big 4”—Net Sales, Gross Profit, Operating, and Net Income—ultimately anchor your ability to make money as you lead your business through the year to your planned results.

The most effective and efficient approach to making more money starts with projecting the next twelve months for Net Sales, Gross Profit, Operating, and Net Income. Start with these four underlying results from your P&L Statement since these numbers matter most to your business.

Net Sales reflects how well you utilize your capital, capacity, and other resources to generate the top line of your business, which funds everything else in your business. Below is how Net Sales is calculated:

Net Sales = Gross Sales – Sales Tax – Sales Discounts – Sales Returns – Bad Debt

Gross Profit measures your first level of profit contribution that comes from transforming a dollar of sales into a profit. The most efficient way to increase Gross Profit is to hold your direct costs while increasing your selling price. Gross profit is calculated as follows:

Gross Profit = Net Sales – Cost of Goods Sold (COGS)

Operating Income is the second level of business profit. It’s the second most important number from your P&L Statement, which measures what it costs you to support your operations out of every dollar of Gross Profit earned. The formula for Operating Income is the following:

Operating Income = Gross Profit – Selling, General, and Administrative Expense (SG&A)

Net Income also called Net Profit is the third level of profitability is the hardest number to impact given its high reliance on the results of sales and operations reflected in Gross Profit and business admin that shapes Operating Income. Below is how Net Income is calculated:

Net Income = Operating Income + Other Income – Other Expenses – Owner’s Compensation – Interest – Taxes – Depreciation – Amortization

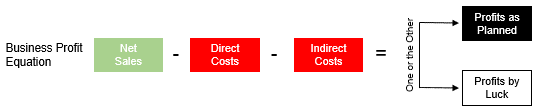

While every number on your P&L Statement impacts the business profit equation, don’t be distracted by all of the line items your accountant can report for you on your P&L Statement.

You either have a plan for earning profits or you don’t. Without a plan to direct and control your business, “How will you know if you’re earning enough to be worthy of your valuable time and investment?”

In the long run, your ability to make money is driven by how much you collect in sales, less your direct costs to produce what you sold and the indirect costs incurred to support your business. These are the numbers making up Net Sales, Gross Profit, Operating, and ultimately Net Income. The “Big 4” is what makes the difference between you making or losing money.

When recognizing what to do to improve business results becomes overwhelming, you don’t want to face the day ahead, step back and focus on the “Big 4.” Looking at how your profits cascade from Net Sales is how you best recognize what needs to change. Click here to have a certified BusinessCPR™ Business Scientist review your P&L Statement to show you the patterns and trends in your business that you can take action to build on and where changes are needed to make more money.

Where is your money going?

Click the link below to learn how your business profit and cash position have changed over the last three years, looking at your year-over-year change by month in cash position and profits. Doing this will help you better see patterns and trends in your business that you can take action to fix. Ultimately, any failure to fix profit leaking from your business is a failure to manage your cash.

Within forty-eight hours of receipt of your core financial statements by month, you will receive back by email your free financial statement review from a certified BusinessCPR™ Business Scientist.

FREE BUSINESS REVIEW