Synopsis

To better position you to benefit from the output of your accounting software and that of your bookkeeper and accountant, there are thirteen principles and concepts about accounting that you need to understand if your goal is to generate predictable cash flow from higher profits.

The function of accounting will never be able to tell you everything about your business. The financial reports produced will tell you the quality of past business decisions and current financial well-being. You only get to know this when you record your financial transactions on an accurate and timely basis.

The understanding of accounting matters because every business of any size starts with cash, which is invested in numerous ways to generate revenue. Ultimately, the revenue produced is turned back into cash, and the cycle begins anew. The financial data resulting from revenue generation is the basis for reporting on the results of operations for a period of time and the company’s current financial position. To better position you to benefit from the output of your accounting software and that of your bookkeeper and accountant, there are thirteen principles and concepts about accounting that you need to understand:

- Money is the common denominator of accounting

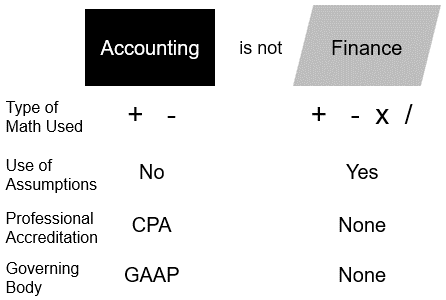

- The only math used in accounting is addition and subtraction, whereas financial analysis also uses multiplication and division.

- The accounting records of your business must be separate from your personal records. The reason for this is the degree of difficulty created in judging the financial performance and health of your business if your personal financial transactions are included in your business entity accounting records.

- Every transaction or accounting event affects at least two items; this is why accounting is called a double-entry system based on the following rule. There is no exception: for each transaction, the debit amount must equal the credit amount. The debit and credit arrangement used in accounting provides a useful means of checking the accuracy with which the transactions have been recorded.

- Time periods should be standardized (monthly, annually, etc.) and not artificial. If this is not done, it will lead to questions about how to handle certain transactions—for example, reporting the cost of equipment that lasts over five years. If the entire expense is reported in the purchase year, it will likely make the company seem unprofitable that year and unreasonably profitable in future years.

- Financial statements are prepared under the assumption that the company will remain in business for the foreseeable future. Therefore, assets do not need to be sold in the short term, and long-term debt does not need to be paid off immediately.

- Historical or Acquisition Cost defines how the CPA should determine the dollar value of each accounting transaction. The basic rule they follow is to use the company’s actual cost incurred in a fair and arms-length For example, if you get a great deal on a delivery truck, you can only put the $10,000 you paid for it on the balance sheet, not the $20,000 that is the truck’s fair market or blue book value.

- Revenue and expenses should be matched when booked to the P&L statement. The reason for this is people reading the financial statements have to know that the financial information is changing due to performance issues and not due to how and when the company decides to book financial transactions to the financial statements. An example is when the company buys materials to make its products in month one, makes the products in month two, and sells them in month three. Under this scenario, if the above timing were not matched to book the transactions to the financial statements, month one would look bad. It would look bad because all the expenses and no revenue were accounted for in month one. Month two would be more of the same as the company incurred labor to make the product but has yet to book any revenue. However, month three would look very good, financially, as all the sales were booked, but there were no corresponding expenses in that month. To prevent this situation, where financial statements go up or down for reasons other than company performance, the material and labor would be charged to inventory. At the same time, it was incurred and only charged to the P&L Statement in the same month, the items were invoiced, and the sale realized. This puts all the sales and costs in the same month, so the profitability numbers and percentages would be due to performance issues and not timing issues.

- Not all expenses can be tied directly to the making of the company’s products and or services. Examples would include accounting fees, advertising, business liability insurance, etc. For these expenses, they are taken to the P&L statement as the bills are received or paid.

- The Materiality Principle says that anything that would materially affect the financial statements must be included and fully disclosed in the financial statements. The guiding principle is if a particular item were included or excluded, would this affect a reasonable person’s decision regarding the company’s financial performance.

- The Relevancy Principle says the financial statements must be prepared in such a way as to outline the company’s past performance, present condition, and future outlook so that intelligent decisions can be made promptly.

- The Reliable Information Principle says that financial statements must be verifiable and objective.

- The Consistency Principle says that once a company has defined how it will do the accounting and what accounting principles it will follow, you have to continue to use them year in and year out. This ensures the people comparing financial reports are making an apples-to-apples comparison, and financial results are changing due to performance issues, not changes in how the accounting is performed. While this is the rule, this is not to say that a company can never change accounting methods and procedures. Everyone realizes that things change, and the accounting systems need to be flexible enough to react to and adapt to this change. However, when a change is necessary, it has to be fully disclosed, the financial impact clearly outlined, and at least the last three years of financial statements restated per the new methods. Hence, comparisons to the prior year’s results remain valid.

When looking at CPA prepared accounting reports, know what CPA “opinion” they have taken

When reviewing financial reports, the accountant who prepared the report will give their opinion of the financial report for the benefit of those analyzing them according to one of the following definitions:

- An unqualified opinion means the accountant has no reservations regarding the financial reports. When the accountant is giving an unqualified opinion, they are saying the accounting principles used in preparing the enclosed financial statements:

- Followed generally accepted accounting principles.

- The accounting principles used are appropriate for the company’s situation.

- What an unqualified opinion does not say is the enclosed financial statements are fraud-proof.

- A modified opinion means there are some factors the reader needs to be aware of. The two most common causes of a modified opinion are a significant change to the accounting methods or material uncertainties to the financial reports. Look for further explanations for both of these reasons in the footnotes of the financial report.

- A qualified opinion means that except for the qualifications noted by the accountant, the financial reports, the financial reports are fairly prepared and presented. Look for the further explanation of this qualification in the footnotes of the report.

- An adverse opinion is one where the accountant is saying the enclosed financial statements have not been correctly and fairly prepared according to the accounting rules.

- A disclaimer of opinion is where the accountant says he has no opinion regarding the enclosed financial reports.

The financial reports prepared for your business are the Report Card of the business that tells if the company made a profit or not. Too often, the information contained on the P&L Statement and Balance Sheet is not used to develop profitable business decisions. Be the exception. Learn to use the numbers the accountants use to validate for yourself the quality of your business performance. Developing mastery over your financial reports is the quickest way to make better and better business decisions.

What do your financial statements say about your business?

Click here for a “free” assessment of your financial statements to see how helpful they likely are to you. Within two days of receipt of your multi-year P&L Statement and Balance Sheet, a certified BusinesCPR™ Business Scientist will review your P&L Statement and Balance Sheet to see what they reveal about your business’s financial well-being.

Are your financial statements accurate?

Click the link below for a “free” assessment of your financial statements to see how helpful they likely are to you. Within two days of receipt of your multi-year P&L Statement and Balance Sheet, a certified BusinesCPR™ Business Scientist will review your P&L Statement and Balance Sheet to see what they reveal about your business's financial well-being.

FREE ASSESSMENT