Synopsis

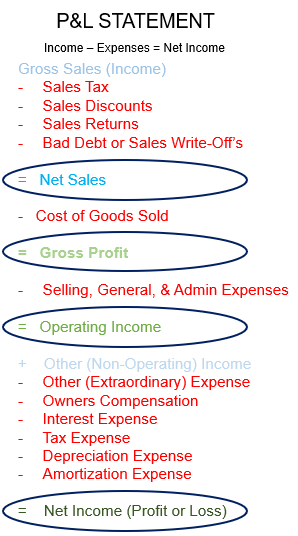

Your business succeeds or fails based on the amount of surplus cash after total costs are deducted from net sales. It is the “Big 4”—net sales, gross profit, operating, and net income—that ultimately anchor your profit plan as you lead your business through the year to your planned results.

The most effective and efficient approach to building a twenty-four-month profit plan starts with projecting the next twelve months for Net Sales, Gross Profit, Operating, and Net Income. Start with these four underlying results from your P&L Statement since these numbers are what matters most to your business.

Every business succeeds or fails based on the surplus cash remaining after total costs are deducted from net sales as determined by the following:

- Sales must be higher than the cost of producing the goods and services you sell, or else there will be no monies left over to pay for operating expenses.

- Costs for resources used to produce and deliver what you sell are called the cost of goods sold (COGS). COGS are the variable costs of your business (i.e., any costs that vary directly according to how much a business produces and sells.) Some common examples of variable costs include:

-

- Direct labor required to sell or produce the service or product;

- Materials required to produce the product;

- Shipping and service delivery costs required to deliver the product or service to the buyer.

- Gross Profit is the amount by which sales revenues exceed production costs (cost of goods sold). You can work toward improving this number by either raising selling prices or reducing COGS. Gross profit is calculated as follows:

Net Sales – COGS = Gross Profit

- The dollar contribution from gross profit represents the amount of money available to pay all other operating expenses, interest, and taxes. It’s the difference between Net Sales and Cost of Goods Sold.

- The amount of your gross profit contribution is the number one determiner if you will have any operating income. Put another way, decreases in gross profit without corresponding decreases in overhead expenses will guarantee that you are not on track to being profitable. The occurrence of this problem is why most business owners struggle with why their P&L shows a profit greater than what their bank balance reports.

- Gross profit margin is the percentage of money the business keeps after the variable costs are subtracted from the sales revenue. Your gross profit margin tells you how efficiently your operations are converting a sale into a profit as a percent of sales. Gross Profit margin is calculated as follows:

Net Sales – COGS = Gross Profit / Net Sales

- Any business expenses that occur, regardless of a sale being made, are considered overhead or “fixed costs” and are accounted for in selling, general, and administrative (SG&A) expenses. Some common examples of fixed costs include:

-

- Advertising;

- Office salaries;

- Insurance;

- Rent and utilities;

- Outside fees paid to a lawyer, an accountant, or your bank.

- Operating Income is the profit resulting from your primary business operations, excluding extraordinary income and expenses. This figure is also called “earnings before interest, taxes, depreciation, and amortization” or (EBITDA). Operating Income is the money the business keeps after subtracting both variable costs and fixed costs from sales revenue. This profit number gives a more accurate picture of a company’s operating profitability than gross profit. It is the primary measure used to determine how profitable a company is in managing its operations. Operating income is calculated as follows:

Gross Profit – SG&A Expense = Operating Income

- The core building blocks of your profit plan involve knowing how much you expect to sell, what you expect those sales to cost, and how much overhead you will need to cover through your Gross Profit. Ultimately, your profit plan will look like your P&L Statement in that it will tell you what you are projecting to do by month for the following “big three” financial results.

Net Sales

– COGS (variable costs)

= Gross Profit

– SG&A Expenses (fixed costs)

= Operating Income (EBITDA)

- Other Income (non-operating), Other Expenses (extraordinary), Interest, Taxes, Depreciation, and Amortization expenses must be planned to establish your Net Income in your profit plan. Taking this tenth step adds a level of complexity that is useless if you have allowed assumptions to enter your profit planning laid out in steps one through nine.

It is the “Big 4”—net sales, gross profit, operating, and net income—that anchor your profit plan as you lead your business through the year to your planned results.

While every number on your P&L Statement impacts the business profit equation, don’t be distracted by all of the line items your accountant can report for you on your P&L Statement. In the long run, your ability to make money is driven by how much you collect in sales less your direct costs to produce what you sold and the indirect costs incurred to support your business. These are the numbers making up Net Sales, Gross Profit, Operating, and ultimately Net Income. The “Big 4” is what makes the difference between you making or losing money.

What should your “Big 4” numbers be?

Are you satisfied with your “Big 4” results? If no, let one of our certified B-CPR business scientists help you identify how much money you should be making based on the time, money, and risk you incur. Within three days of receipt of your P&L Statement and Balance Sheet by month, you will receive back an assessment of what you should be making and three ideas for you to act on to make more money.

What should your “Big 4” numbers be?

Are you satisfied with your “Big 4” results? If no, let one of our certified B-CPR ¬business scientists help you identify how much money you should be making based on the time, money, and risk you incur. Within three days of receipt of your P&L Statement and Balance Sheet by month, you will receive back an assessment of what you should be making and three ideas for you to act on to make more money.

FREE ASSESSMENT