Synopsis

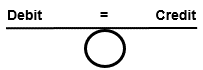

The purpose of double-entry accounting is to provide a business owner with the opportunity to apply two equal and corresponding sides, known as debits and credits, to the financial transactions occurring in their business are recorded accurately. Debit in Latin means "he owes;" credit means "he trusts."

Every business transaction creates an accounting event that affects at least two areas of your business financials. This is why accounting is called a double-entry system based on the following rule, to which there is no exception: for each transaction, the debit amount must equal the credit amount. Since 1494, the debit and credit arrangement used in accounting has been the mechanism for confirming the accuracy of business transaction recording.

Appreciating the significance of Luca Pacioli to your business

Modern-day business failures occurring all around us each day are even more amazing when you consider a little bit of history: In 1494, Luca Pacioli published a twenty-seven-page treatise on bookkeeping. In effect, Pacioli explained double-entry bookkeeping to Italian merchants. His body of work, written over 500 years ago, led to his being recognized as the father of professional accounting and bookkeeping.

He explained that the purpose of double-entry accounting is to provide a business owner with the opportunity to apply two equal and corresponding sides, known as debits and credits, to the financial transactions occurring in their business. Debit in Latin means “he owes;” credit means “he trusts.”

Pacioli’s book also gave instructions for recording transactions in various currencies, thus establishing the “C” in B-CPR by enabling merchants to report their transactions and, ultimately, manage their cash. The ability to calculate the “P” for profits was established by learning how to record each business transaction accurately. This, in turn, established the “R” for reporting in Business CPR. By accurately reporting debits and credits, everything necessary for a business to succeed became available to the inquiring business owner in 1494.

Today, just as the merchants influenced by Pacioli, we come to know whether revenues (R) are greater than expenses (E.) When R > E, the result is profits. And when R < E, the business has suffered a loss.

Pacioli also referenced that merchants who failed to maintain their records were at higher risk of business failure. It was pointed out that the merchants who used double-entry bookkeeping had access to important information about their business to take effective action to stop losses and increase profits.

Over 525 years later, business owners worldwide will still end a day, a week, a month, and even a year without accurately reporting on transactions, just like the struggling merchants Pacioli tried to help in 1494. Their failure to practice the “R” for “reporting” in Business CPR prevents them from knowing if they are “P,” profitable or not. When a business is not profitable, it leads to immediate issues involving a lack of “C” for cash.

Below are the three core terms that ensure your accounting process produces accurate financial statements:

Credit: The right side of the T form of an account, the actual amount on the right side of an account, or the act of placing an amount on the right side of an account.

Debit: The left side of the T form of an account, the actual amount on the left side of an account, or the act of placing an amount on the left side of an account.

Trial Balance: A statement that shows the name and balance of all ledger accounts arranged according to whether they are debits or credits. The total of the debits must equal the total of the credits in this statement.

Debits and Credits apply the principle of double-entry accounting to every financial transaction, as reflected in the following image:

Below is how debits and credits are classified and recorded relative to how they increase and decrease a business transaction according to the following five basic units of accounting:

- Assets represent the capital deployed to generate profits and cash flows and are classified according to the ease with which they can be converted into cash.

| DEBIT | CREDIT | |

| Assets are normally a DEBIT = VALUE | Increase = Good

(have more) |

Decrease = Bad

(have less) |

- Liabilities are the claim against a company’s assets or legal obligations arising out of past or current transactions or actions. Liabilities require the mandatory transfer of assets, or provision of services, at specified dates or indeterminable

| DEBIT | CREDIT | |

| Liabilities are normally a CREDIT = $ OWED | Decrease = Good

(owe less) |

Increase = Bad

(Owe More) |

- Owners’ Equity represents the capital employed in a company, computed by deducting the book value of the liabilities from the book value of the assets. It represents what is available for the owner after everyone else has been paid.

| DEBIT | CREDIT | |

| Equity is hopefully a credit = WORTH $ | Decrease = Bad

(worth less) |

Increase = Good

(Worth more) |

- Revenues represent the income generated from the sale of goods or services associated with the primary operations of a company before any costs or expenses are deducted. Revenues do not represent a profit or available cash.

| DEBIT | CREDIT | |

| Revenues are always a CREDIT = SALES except for sales write-offs | Decrease = Bad

(sold less) |

Increase = Good

(sold more) |

- Expenses represent the money spent or cost incurred in a company’s efforts to generate revenue, representing the cost of doing business. Expenses are summarized and charged in the income statement as deductions from the income before assessing an income

| DEBIT | CREDIT | |

| Expenses are always a DEBIT = SPENDING except for vendor refunds | Increase = Bad

(spent more) |

Decrease = Good

(spent less) |

It is always advisable to reconcile your bank accounts each month to ensure your cash balance shown on a bank statement and the amount shown in the account holder’s records balance. The result of your reconciliation will lead to an adjustment of any discrepancies that exist. Once corrected, both your bank account and financial statement records will be in agreement. This is the only way to ensure that your debits equal your credits.

Accounting accurately and on a timely basis for your debits and credits is how you know if your business made a profit or not. Too often, the information contained on the P&L Statement and Balance Sheet is not used to make more profitable business decisions. Be the exception. Learn to use the numbers reported on your financial statements to validate your company’s performance so you continuously make better and better decisions.

Are your financial statements an asset or a decision-making liability?

If you struggle with recording your business transactions into your accounting software on a timely basis, click here to see how at risk your business is to fail in the next three years because you don’t consistently record your business transactions in your accounting software. Upon completing the BusinessCPR™ Business Assessment, you will receive a risk profile showing how at risk your business is to suffering cash flow and profit problems, the primary cause of business cardiac arrest.

How well are your financial statements working for you?

If you struggle with recording your business transactions into your accounting software on a timely basis, click the link below to see how at risk your business is to fail in the next three years because you don't consistently record your business transactions in your accounting software. Upon completing the BusinessCPR™ Business Assessment, you will receive a risk profile showing how at risk your business is to suffering cash flow and profit problems, the primary cause of business cardiac arrest.

EXPRESS ASSESSMENT