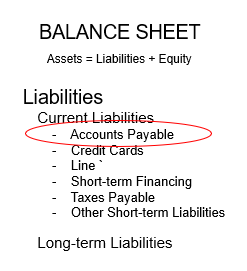

Accounts Payable (A/P) is a Current Liability on the Balance Sheet representing the short-term debts a business owes to its suppliers and vendors for goods and services received on credit.

Primary Implication

If your accounts payable are greater than your accounts receivable, you have a problem. If you cash on hand as a percent of target is less than 1 then you have a serious revenue to expense problem that needs to be addressed immediately.

What expenses can you end immediately to prevent further increases in A/P?

Overview

Accounts Payable (A/P) represents the amount of money a company still owes creditors (suppliers, etc.) in return for their goods and services. This value includes unpaid bills owed to suppliers (trade creditors) as distinguished from accrued interest, rent, salaries, taxes, and other such accounts.

Accounts payable are shown under current liabilities in the Balance Sheet. Lenders and investors typically examine the relationship of these accounts to judge the soundness of a business’s day-to-day financial management.

When processing A/P, avoid transposing errors or failing to record the expense in the right GL account. It is also important that you are timely and disciplined in matching delivery receipts with invoices. This business practice is the best way to detect fraudulent activity from either employees or vendors.