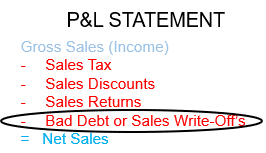

Bad debt or sales written off refers to the amount of money owed to a business that is deemed uncollectible and subsequently written off as a loss.

Preliminary Implication

Bad Debt is not only a reduction in Gross Sales, it also represents the loss of cash inflow from the collection on a sale and profit losses tied to the production of the sale that you never get paid for delivering.

You can spot a weak business owner by merely looking at the amount of A/R aging greater than 90 days. High balances past due more than 90 days indicate an owner who doesn’t pay attention to the Accounts Receivable, which means you have an owner who struggles with holding onto cash and making a profit.

If you aren’t expecting to get paid, it is always better not to make the sale to avoid spending the money and time to do the work tied to that sale.

Overview

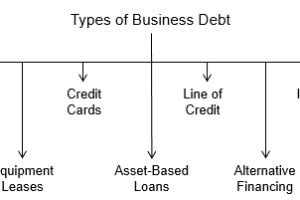

The risk associated with extending payment terms to your customers is proportionate to the probability of your being paid for what becomes an account receivable. Every time you fail to collect on an accounts receivable leads to the opportunity to occur bad debt.

Bad debt represents gross sales that are written off because they are viewed as unlikely to be paid. They contribute to the difference between Gross Sales and Net Sales. When a sale is written off, it’s as if the sale never occurred. Writing off bad debt as a loss against its sales revenue is the recommended way for deducting the uncollectible amounts from revenue in the accounting period they are deemed uncollectible. It is the cleanest and easiest way to unrecognize a sale through the direct write-off method.

The allowance method deducts an estimated amount from revenue in each accounting period and adjusting any excess or shortfall in the following accounting period. Use this method if you write-off a large portion of your sales each month.

Rather than have to worry about selecting the best accounting method to apply to your bad debt, it is always better to collect the money owed to you. Improve your ability to get paid for work you have sold on payment terms by following an account receivable collection process. Do this to improve the ratio of bad debt losses and the open account (credit) sales. Fail to do this you will not only have a good indicator of the quality of your collectibles, and the efficiency of your credit monitoring efforts, you will have less money.