Assets are resources with economic value reported on a Balance Sheet that a business owns and controls, with the expectation that they will provide future benefits.

Primary Implication

The real value of the total assets reported on your Balance Sheet isn’t the amount reported. It’s how well your assets contribute to the production of sales at a profit for your company. Assets that generate more value than they cost is the key to making more money.

Don’t distract management’s attention or tie up cash on any assets that don’t contribute to you earning more on the asset than the asset costs.

Overview

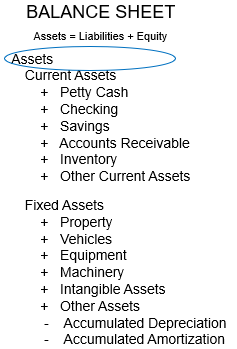

Assets represent the capital deployed to generate profits and cash flows. Asset values shown on the Balance Sheet are classified according to the ease with which each asset can be liquidated or converted into cash.

Current assets include cash, inventory, marketable securities, and enforceable claims against others, such as accounts receivable.

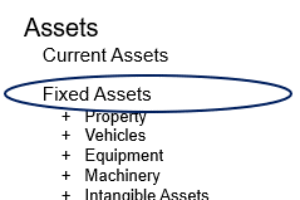

Fixed assets include furniture, equipment machinery, vehicles, land, and building. They can also be a right to use, such as copyright, patent, trademark, or an assumption, like goodwill.

When people talk about asset values, particularly as it relates to purchasing them, it is vital to confirm if they are talking about asset cost, book value, market value, or residual value for the asset.