A Balance Sheet is a financial statement considered a snapshot of a company’s assets, liabilities, and owners’ equity on the reported date.

Preliminary Implication

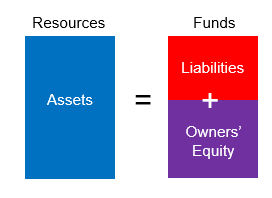

The primary purpose of your Balance Sheet is to communicate the ownership split on the assets used in the business to generate sales at a profit. If liabilities are significantly higher than owners’ equity, that indicates the creditors have a higher claim against the assets of the business than the owners’ do.

Using other people’s money to acquire needed assets has its advantages until you lose your ability to repay those you borrow from or generate a return for those who have invested in your business. Protect yourself from the problems associated with angry creditors and shareholders by making sure your assets work harder than the monies entrusted to you, or you will have problems.

Overview

The Balance Sheet lists company assets, how it paid for them, and what it still owes (its liabilities). The difference between what it paid after depreciation and the amount left goes to the owners after satisfying the liabilities. The purpose of this financial statement is to list, at any point in time, your company’s measurable resources in:

- Assets – Your capacity to produce revenue.

- Liabilities – Your borrowings to acquire these assets and pay your bills.

- Equity – Your investment as the owner represents your claim against your assets after settling liabilities.

Remember, the owner’s equity is not the same as the owner’s piggy bank; it represents the owner’s claim on the company assets left over after all liabilities have been paid off.