The breakeven sales point is the level of revenue where a business’s total sales exactly cover its total expenses, resulting in zero profit or loss.

Primary Implication

A low breakeven sales point indicates a healthier and less risky business investment because the business has fewer fixed costs representing overhead. Put another way, when a smaller percentage of your sales is required to cover indirect costs, you are less susceptible to burning through your cash reserves when sales decline.

To avoid unnecessary stress in life and business, be very careful in taking on any new expense that does not directly contribute to your making a sale at a profit. Too many business owners justify additional overhead expenses based on their net sales, failing to appreciate that they pay for every nonrevenue contributing expense through their gross profit.

Overview

The Breakeven Sales Point represents the point-in-time at which a business, product, or project becomes financially profitable. This occurs when revenue exactly equals the estimated total costs, such that loss ends, and profit begins to accumulate.

The higher the asset base required to generate sales, the more critical it is to know the breakeven point in your business cycle. This number is relatively meaningless for businesses with low overhead and few assets to support.

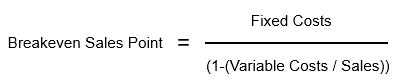

The formula for calculating your Breakeven Sales Point

Fixed Costs/(1-(Variable Costs/Sales))

A company with $500k in fixed costs and $750K in variable costs must generate $1,250K in sales to breakeven. Should they generate $1,500K in sales on the $1,250 in total expenses, they will earn $250K in profits. They will generate less than $1,250K in sales and lose money because they are below breakeven.

Lower Creates Opportunity: A lower breakeven point indicates a healthier and less risky business investment.

Higher Creates Challenges: A higher breakeven point confirms that the business has a high-cost structure, with many moving parts to pay for before they earn a profit.