The chart of accounts is a structured list of all the financial accounts used by a business to categorize its transactions and organize its financial records.

Primary Implication

Failure to accurately record a business transaction in the correct chart of accounts leads to incorrect financial statements resulting in the wrong decisions getting made.

The most common transaction classification mistake is recording a direct cost as an indirect expense. This results in understating the cost of goods sold, which overstates your gross profit and indirect costs. Do this, and you will think your pricing is right and that you have an overhead problem when, in reality, you aren’t charging enough to cover your direct costs because you have an expense classification problem.

Correct this by ensuring each transaction’s recording is in its correct Chart of Account.

Overview

The backbone for accounting accuracy is the Chart of Accounts or COA. It forms the underlying foundation that allows you to record and track your company’s financial progress.

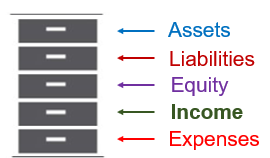

Every COA is the equivalent to using a five-drawer filing cabinet to store all of your different business transactions. Each drawer represents a different account type created within the COA as virtual “folders” that fit into one of the following seven drawers.

- Assets—These are the items that your business has in its possession: monies that you have in your bank accounts, inventory that you have on-hand, or equipment used in your operations.

- Liabilities—These include monies that your business owes to others: an auto loan on a car you use for business, a mortgage that you carry on your warehouse, or sales tax you’ve collected from your customers, and that has not yet been paid to the state.

- Owner’s Equity—Equity is everything your business owns: any money that an owner invests in their business is considered equity.

- Income—Income is the proceeds from the sale of products or services. For example, selling plumbing services or selling five lamps to a customer is considered income. Nonoperating income such as interest income, tax refunds, insurance settlements, and the like involve monies coming into the business that are not generated by your normal operations.

- Expenses—This is your largest drawer organized into direct, variable, and other expenses.

a. Cost of Goods Sold—These are what you purchase to complete an order, such as direct labor, materials, and equipment used to produce goods or services that are then invoiced to your customers.

b. Expenses—These are items that you pay to run your day-to-day business operations. For example, advertising expenses, office payroll, insurance, and office supplies are all categorized as expenses.

c. Other Expenses—Transactions kept in the back of the expense drawer involve all nonoperating expenses. Here, you will find extraordinary expenses, interest expenses, taxes, depreciation, and amortization expenses.

Smart business owners maintain an accurate COA as part of their habit of accurate + timely record-keeping.