Asset Cost is the total reported of money of an asset reported on a Balance Sheet that was expended to acquire, prepare, and bring an asset to its intended condition for use.

Primary Implication

When purchasing a fixed asset that will reside on your Balance Sheet, keep track of all of the associated costs with acquiring and setting up your new asset for review by your accountant. Let them decide what costs tied to the asset cost you get to use to set up the asset value and which you will have to expense.

Your role is to make the total asset cost information available to your accountant to avoid under-representing the value of your fixed assets.

Overview

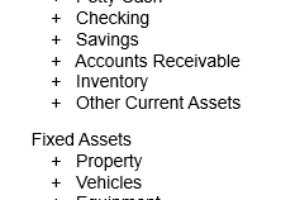

Asset costs reflects the original cost of an asset inclusive of all of the items directly attributed to its purchase and to putting the asset to use. Asset costs reported on a Balance Sheet include the purchase price and other costs incurred such as commissions, transportation, appraisals, warranties, installation, and testing if not included in the purchase price.