Accounts Payable Days Outstanding is an Efficiency Ratio that measures the average number of days it takes the business to make their payable payments.

Primary Implication

Accounts payable days outstanding below 30-days indicate that you are paying your vendors too quickly. In comparison, a number higher than 50-days indicate possible payment problems and increasing pressure on cash flow.

The weekly application of a cash management process will help you keep your payment obligations for your suppliers. This is particularly important when you need your supplier to go above and beyond for you. Those who aren’t paid on time are less likely to step up when you need them.

Overview

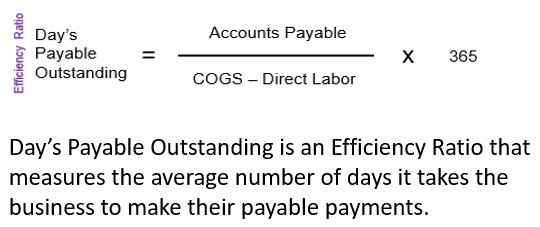

Day’s Payable Outstanding is an Efficiency Ratio that measures the average number of days it takes the business to make their payable payments. The length of time it takes to clear all outstanding Accounts Payable (A/P) is a useful number for determining how efficiently the company is clearing its short-term liability obligations.

The formula for calculating the Day’s Payable Outstanding

(Accounts Payable / (COGS-Direct Labor)) X 365

A/P Days of 35 establishes that the average number of days it takes to pay your vendors is 35-days from the date of invoice.

On-Time is Best: Numbers lower than 30 days indicate that you are paying your vendors too quickly.

Longer is Worse: Numbers much higher than 50 days indicate possible payment problems and significant pressure on cash flows.