A Business Assessment establishes what needs to start, stop, and continue.

Primary Implication

Businesses with predictable cash flow, strong profits, and accurate reports timely delivered never face the question, “is this a good business to buy?” People buy these businesses at a premium because they can easily understand how cash is generated, and profits are achieved through the financial reports produced. These businesses have disciplined owners who assess the quality of their decisions and actions as verified through their financial results.

Overview

What is a business assessment?

A business assessment establishes what needs to start, stop, and continue. Its purpose is to diagnose what’s working well in the business, where the business is getting stuck, and what needs to be done differently. Business assessments are like physical exams where a healthcare provider studies your body to identify any physical problems that need medical attention.

A well-designed business assessment serves the same purpose as a physical examination. Vital signs are checked, physical appearance is evaluated, medications are reviewed, and lab work is performed. All of this is done to assess for any issues that may become medical concerns in the future.

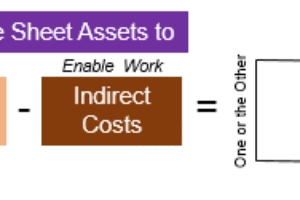

The business vital signs assessed start with changes in Net Sales, Gross Profit, Operating, and Net Income to measure the quality of business operations. A balance sheet review is performed to establish the effectiveness of ownership decision-making. Here, we are looking at the sales, profit, and cash reserve health of a business that is shaped by the cash quality and speed of collection the business generates each time it completes a transaction. The faster and higher the return on the cash invested to get paid for a sale, the healthier the business. Failure to earn a profit on a sale means the cash invested in assets and expenses is not generating a return. Worse yet, failing to collect the money owed from a sale means you never get paid for the cash invested in assets and expenses.

Just as an unhealthy heart puts you at increased risk of flatlining if immediate changes to your lifestyle aren’t made as a result of cardiovascular disease, the same can be true for your business. The health of your operating cash flow is shaped by improving your understanding of how your management actions shape the quality of your profits as reported through your financial statements.

Positive cash flow and profitability never just happen in any business. Both are achieved through disciplined planning, accountable follow-through, and accurate and timely reporting of your hard work and sacrifice results.

Businesses with predictable cash flow, strong profits, and accurate reports timely delivered never face the question, “is this a good business to buy?” People buy these businesses at a premium because they can easily understand how cash is generated and profits are achieved through the financial reports produced. These businesses have disciplined owners who assess the quality of their decisions and actions as verified through their financial results.

Leave a Reply

Your email is safe with us.