A business profit model describes how a business generates sales, manages costs, and ultimately earns profit.

Primary Implication

A business that trades one dollar of sales into four quarters or less after the costs in a business have been paid has a broken business model.

Failing to earn more on sales than it costs you to produce the sales means you need to revisit your business profit model because you should get closer to $1.10 or ten cents back on every dollar you collect in sales at a minimum. Anything less than $1.00 on each dollar of sales is a loss.

Overview

A business profit model defines how a business will generate sales at a profit, resulting in continuously improving cash reserves. Put another way, failing to generate sufficient sales to cover business operating costs means you don’t have a profit model.

The gross, operating, and net profits a business produces, as reported in the P&L Statement, is the best reflection of management’s performance. A business that earns profits has a profit model that is working. The lack of profits or lower-than-planned profits from business operations indicates that there are issues with either your profit model or management’s ability to execute the model.

Through your P&L Statement, you will see an itemization of the revenues and expenses that flow through your profit model, leading to either a profit or loss. Below are the core profit-making components for every business:

- Your Profit Model shows you how you intend to make money.

- Your Profit Plan establishes what you should make from the sales generated through your profit model and

- Your P&L Statement shows you what you did make.

A positive difference between actual P&L Statement results and your Profit Plan indicates that you made more money than you planned to make. A negative difference, even if you showed a profit, confirms you aren’t working your Profit Model as you should by failing to meet your Profit Plan.

A business is only viable when it has a proven business model for generating more sales at higher profits year in and year out.

Use your business Profit Model to lay out the profit principles you must follow to make more money consistently. Use it to shape how decisions get made, particularly as it relates to hiring the right people to work for you.

Use your P&L Statement and key performance metrics to manage your business by to help you recognize what’s getting in the way of your earning the profits you should.

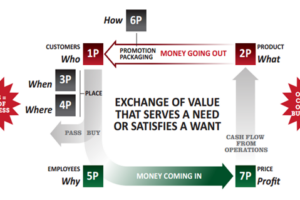

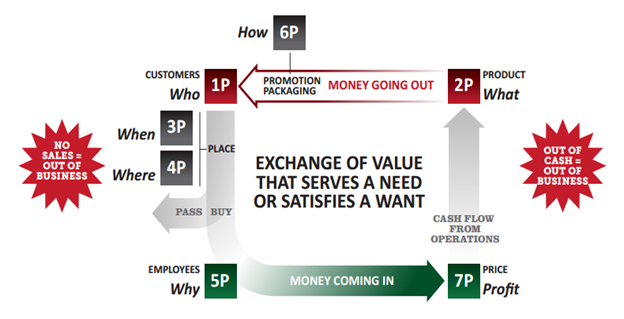

If either of these are difficult for you, use the Business CPR™ Management System to stabilize your business model if you are at an increased risk of going out of business. Use the 7-P Framework if you want your business profit model to work harder for you than you work in your business.