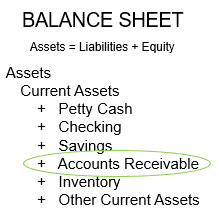

Accounts Receivable (A/R) is a current asset representing the money owed to a business by its customers for goods and services that have been sold on credit.

Primary Implication

If the current A/R is lower than past due A/R (greater than 45 days past due), you have an A/R collections problem. Fail to collect the money you owe you will have problems paying those you owe money.

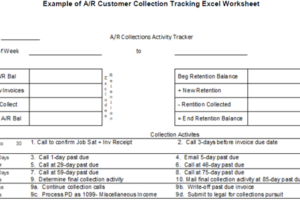

Protect your business from running out of cash by implementing an A/R collections process to ensure people pay you on time.

Overview

Accounts Receivable, or A/R, consists of sales made but not yet paid for by the customers (trade debtors). This number represents the amount of money still owed to you by customers after they have received the goods or services you’ve delivered.

The balance sheet shows Accounts receivables as current (short-term) assets. They represent unsecured promises by your customers to pay you in the future. These sums must be accurate, as they are critical to determining business liquidity.