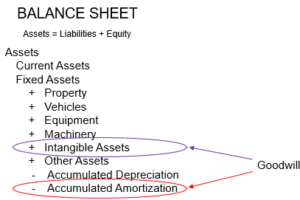

Accumulated Amortization is an asset account of the total amount of amortization expense that has been recognized over the life of an intangible asset.

Primary Implication

Disregard looking at this result unless your tax accountant advises otherwise.

Overview

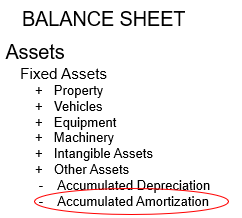

Accumulated amortization of assets refers to allocating the cost of an intangible asset over a period of time. These amounts recorded on the Balance Sheet reflect the total allowed accumulated amortization over the life of the asset. Once the asset is removed from the balance sheet, the equivalent amortization is removed as well.

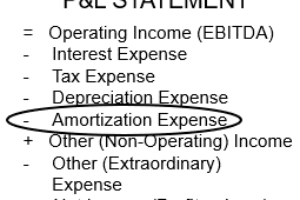

The expensed portion of amortization is recorded on the P&L Statement, after Operating Income. Each time amortization is expensed, the amount expensed is added to the accumulated amounts reflected on the Balance Sheet.

The Balance Sheets Accumulated Amortization amount is from the time the assets were acquired, until the date of the balance sheet. Amortization represents the cost of capital assets used over time and is a contra asset account that offsets the fixed asset account. Any time an amortized asset is sold, the accumulated amortization reported for that asset is removed from the Balance Sheet along with the reported asset value.