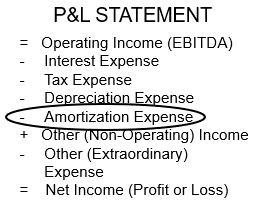

Amortization Expense is a Nonoperating reported expense of the consumption of the economic benefits.of an intangible asset.

Primary Implication

Let your accountant worry about setting the expense portion of intangible assets considered consumed. You have more important things to worry about.

Overview

Amortization expense is a gradual and periodic reduction of the cost of an intangible asset. Both depreciation and amortization expenses are non-cash expenses. They do not represent a cash outflow on the P&L Statement since you do not write a check for either of these costs of doing business. This is because the relevant cash outflow happened at the time the asset was purchased.

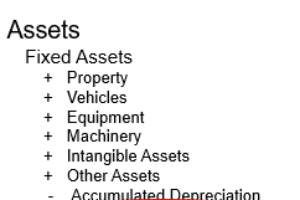

When reported on the P&L Statement, this expense will reduce Net Income. It should never represent the total amount of amortization that is reflected on your Balance Sheet. The amount reported on the balance sheet is the accumulated or the cumulative total amount of amortization that has been reported as expensed on the income statement.