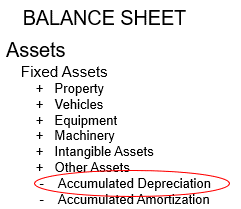

Accumulated Depreciation is an Asset account reporting the total amount of depreciation expense that has been allocated to a fixed asset since it was put into use.

Primary Implication

Disregard looking at this result unless your tax accountant advises otherwise.

Overview

Accumulated depreciation represents the expired value of an asset; it is neither cash nor any other type of asset that can be used to buy another asset. Its purpose is to spread the cost of a fixed asset over its useful life to accurately match the cost of the asset with the revenue it generates. Accumulated depreciation is calculated by dividing the asset’s cost by its useful life.

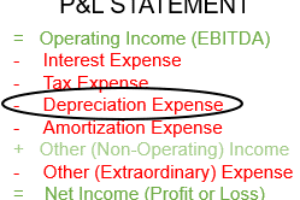

The expensed portion of depreciation is recorded on the P&L Statement, after Operating Income. Each time depreciation is expensed, the amount expensed is added to the accumulated amounts reflected on the Balance Sheet.

The Balance Sheets Accumulated Depreciation amount is from the time the physical assets were acquired, until the date of the balance sheet. Accumulated depreciation represents the cost of the assets used over time and is a contra asset account that offsets the fixed asset account. Any time an amortized asset is sold, the accumulated depreciation reported for that asset is removed from the Balance Sheet along with the reported asset value.