The function of accounting is to accurately record, summarize, analyze, and report a business’s financial transactions to provide insights into its financial performance, position, and cash flow.

Primary Implication

Failures in accounting occur anytime a business transaction is recorded late, inaccurately, or not at all.

The quality of your business decisions influenced by your financial statements is proportionate to the accuracy and timeliness of your business transaction recording. Fail to record your business transactions; you rob yourself of the opportunity to know if your business actions and investments are producing profits or losses.

Avoid this failure by entering your business transactions for the previous week within a week of their occurring.

Overview

The understanding of accounting matters because every business of any size starts with cash, which is invested in numerous ways to generate revenue. Ultimately, the revenue produced is turned back into cash, and the cycle begins anew. The financial data resulting from revenue generation is the basis for reporting on the results of operations for a period of time and the current financial position of the company.

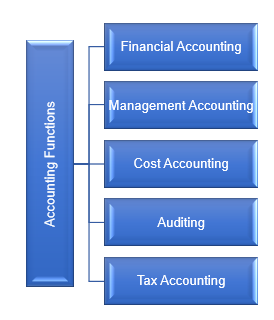

Within the function of accounting are the following five core accounting practices:

- Financial accounting uses money as the means of measuring economic performance, including the monitoring and control of money as it flows in and out of an organization as assets, liabilities, revenues, and expenses. The captured transaction information is used to prepare financial reports such as P&L Statement, Balance Sheet, and Statement of Cash Flows for management, investors, lenders, suppliers, tax authorities, and other stakeholders to assess company performance.

- Management accounting represents the process of preparing management reports from the recorded business transactions to provide accurate and timely financial and statistical information required by managers to make informed business decisions. Unlike financial accounting, which produces annual reports mainly for external stakeholders, management accounting generates monthly or weekly reports for management to see the amount of available cash, sales revenue generated, state of accounts payable and accounts receivable, outstanding debts, raw material, and inventory. Advanced business management accounting includes trend charts, variance analysis, and other statistical reporting.

- Cost accounting collects, classifies, and records the costs incurred in carrying out an activity or accomplishing a purpose are. Management uses this output to set selling prices and to determine where cost savings need to be captured. In contrast to financial accounting that uses money as the measure of economic performance, cost accounting considers money as the economic factor of production that stands between what you generate in sales and earn in profits.

- Tax accounting is the management of accounting practices according to tax laws as regulated by the IRS.

- Auditing is the systematic examination and verification of the transaction records, accounts, other relevant documents, and physical inspection of inventory by qualified accountants to confirm the accuracy of the financial statements being reported.

The function of accounting will never tell you everything about your business. What it will tell you without bias through your financial statement reporting is the quality of your business decisions and financial well-being. You only get to know this when you record your financial transactions on an accurate and timely basis.