The Accounts Receivable Turnover Ratio is an efficiency measures teliing for how many times a business collects its average accounts receivable balance during a year.

Primary Implication

Accounts Receivable Days of 50 days or more indicate collection problems. Allow this problem to go uncorrected, and you will have cash flow pressures.

Allow ARD to increase, and you will have a significant cash flow problem unless you can convince your suppliers and subcontractors to allow you to pay them when you get paid. Absent a paid when paid agreement on your payables means you need to collect the money owed you because those you owe will pressure you to pay them.

Reduce your ARD by managing your A/R collections process.

Overview

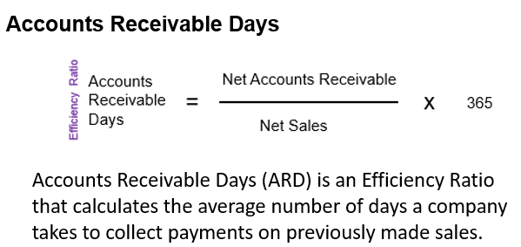

Accounts Receivable Days (ARD) is an Efficiency Ratio that calculates the average number of days a company takes to collect payments on previously made sales. Also called Days Sales in Receivables or Debtor Days. It represents the length of time it takes to clear all Accounts Receivable (A/R), or how long it takes to receive the money for goods sold. This is a useful number for determining how efficiently the company collects the money owed to them by their customers.

The Accounts Receiveable Days formula

(Net Accounts Receivable / Net Sales) X 365

A/R Days of 45 establishes that the average days it takes to collect payment from your customers is 45 days. Customers taking longer to pay may represent bad debt, whereas customers who pay on time are more valuable and should be retained.

Shorter is Better: Lower than 30 days may indicate that credit policies are too strict, preventing the business from making higher revenues.

Longer is Worse: An ARD of 50 days or more indicates collection problems, which pressure cash flows significantly.